Earlier this year, when Texas Gov. Rick Perry (R) was still a presidential candidate, he took aim at Mitt Romney's controversial private-sector background. Perry told voters, "There is something inherently wrong when getting rich off failure and sticking it to someone else is how you do your business."

The notion of "getting rich off failure" is certainly a tough one to grasp. I suspect most Americans believe business success is dependent on the opposite -- one invests in a venture, and if the enterprise thrives, the investor benefits. Capitalizing off failure, though, is harder to understand.

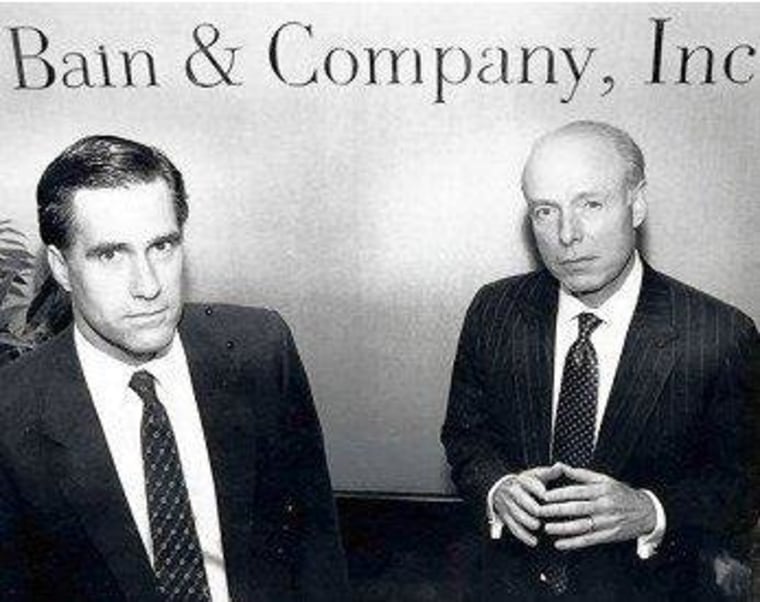

But for Romney, the key to appreciating his private-sector accomplishments is acknowledging his habit of making enormous sums of money from failure. The New York Times had this report over the weekend.

The private equity firm, co-founded and run by Mitt Romney, held a majority stake in more than 40 United States-based companies from its inception in 1984 to early 1999.... Of those companies, at least seven eventually filed for bankruptcy while Bain remained involved, or shortly afterward, according to a review by The New York Times. In some instances, hundreds of employees lost their jobs. In most of those cases, however, records and interviews suggest that Bain and its executives still found a way to make money. [...]He has fended off attacks about job losses at companies Bain owned, saying, "Sometimes investments don't work and you're not successful." But an examination of what happened when companies Bain controlled wound up in bankruptcy highlights just how different Bain and other private equity firms are from typical denizens of the real economy, from mom-and-pop stores to bootstrapping entrepreneurial ventures.Bain structured deals so that it was difficult for the firm and its executives to ever really lose, even if practically everyone else involved with the company that Bain owned did, including its employees, creditors and even, at times, investors in Bain's funds.

In several instances, even when Romney's firm drove companies into bankruptcy, and even when Bain's own investors lost, Romney made millions, thanks to fees he charged the companies as they spiraled towards collapse. Taking risks may be a key element to successful capitalism, but this Republican created a system in which risk taking wasn't necessary.

As far as the election is concerned, Romney is telling voters this background helps prove his qualifications for the presidency. I still haven't the foggiest idea why.