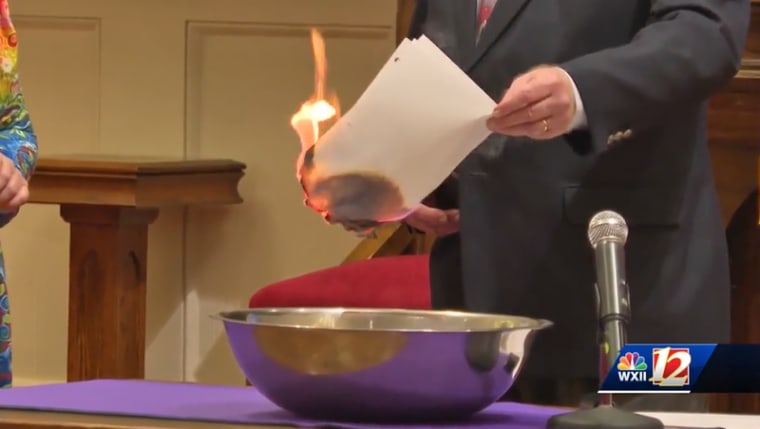

Recently, amid the partisan posturing and Bud Light backlash, a 23-second video of a church congregation burning medical debts went viral on social media. The church, Trinity Moravian of Winston-Salem, North Carolina, collaborated with the nonprofit I lead, RIP Medical Debt, to erase $3.3 million of unpayable medical debt for more than 3,300 people. The church’s donation to RIP, which reflects the cost of acquiring and abolishing the debt, was just $15,000.

How does such a small investment turn into significant relief? By leveraging the for-profit debt market. Like other debts, medical debt can be sold to for-profit entities in bulk, priced at pennies (or less) on the dollar. The debts are sold dirt cheap because the majority are owed by people who simply cannot pay.

The buyer, however, is betting that they can get enough debtors to pay all or a portion of what they owe to make a profit on their investment. The seller (let’s say a hospital) gets to offload debt it has been unable to collect on, for some compensation, and the buyer becomes the owner of a high volume of potential opportunities to collect a profit.

At RIP, we use donor dollars to purchase debt portfolios from health care providers in a similar fashion to for-profit buyers. RIP focuses on those with incomes four times or more below the federal poverty level, or those for whom a debt is 5% or more of their annual income, so we know we’re helping those most financially burdened. But instead of hassling these debtors, we erase unpayable bills and inform them that those debts have been cancelled. On average, just one donated dollar equals $100 of medical debt relief. (For visual learners, here’s a video explainer we put together.)

Last year medical debt represented the majority of all collections on credit reports.

Hospitals that work with us recognize the harm caused by medical debt. They know people don’t get the care they need, experience emotional anguish and make difficult financial decisions because of medical debt. Though 92% of Americans have health insurance, last year medical debt represented the majority of all collections on credit reports. The Kaiser Family Foundation estimates Americans owe at least $195 billion. The real number is likely higher, as KFF’s estimate relies on credit reports; medical debt is often stashed on credit cards — which is then categorized by credit agencies as credit card debt — or money is borrowed from friends and families diffusing and masking the debt in the community.

While the medical debt crisis is dire, there have been positive developments. The top three credit reporting agencies announced changes, co-signed by the Consumer Financial Protection Bureau, that would reduce the financial impact of some medical debts. For example, starting this year, medical debts below $500 can’t be listed on consumer credit reports. At the local level, RIP also has been partnering with counties, cities and states to leverage federal funds from the American Rescue Plan Act to abolish millions in medical debt, starting in Cook County. This approach has been lauded by the White House and will empower us to help millions more people over the next few years.

But we’re a long way from solving this complex issue. Even when removed from credit reports, medical debt continues to harm people. Studies show that individuals with debt are three times more likely to struggle with mental health issues like anxiety and depression, and we know that even fear of debt can prevent people from seeking necessary care. Almost half of respondents to a Commonwealth survey skipped or delayed care because of cost.

"My credit was so shot because of medical debt I couldn’t even sign for his student loan."

And I want to be very clear: What RIP does, while incredibly important for the millions of families we’ve helped to date by abolishing billions in medical debt, is only a last-minute intervention. Systemic reforms are necessary for true positive change. That’s why, in addition to erasing existing debts, RIP advocates for solutions like making health insurance affordable and comprehensive, ensuring that financial aid policies are clear, robust and presumptive (no need for people to apply), and banning extraordinary collection practices like lawsuits and wage garnishment. We’re also advocating for federal changes like Congress addressing out-of-pocket costs and keeping premiums low, investing in consumer assistance to ensure people understand their coverage, and protecting people from high interest rates on payment plans for medical bills.

One of the core principles of our work is letting the constituents — those individuals we relieve of unpayable debts — guide us with their testimony and lived experiences. One constituent, Etienne, is a veteran who ended up needing surgery for an injury he sustained during his service. He found himself surrounded by mountains of medical debt that he couldn’t pay. He shared with us, “I have four kids. One of my kids is in college. My credit was so shot because of medical debt I couldn’t even sign for his student loan. How worthless or useless do you feel after that, being a father, when you can’t even help your kid go to school to get into the medical field to help more people?”

We can’t look away from the heartbreaking realities of medical debt in this country. We need to let them inform the work. And if debt relief provides a brief respite or helps chip away at the stigma of unpaid medical bills, then that’s a great start.