That tax deal that was supposedly taking shape earlier this week no longer seems so inevitable. But there’s still time before the end of the year, and if there does end up being a deal, we at least know roughly what it will look like now–and there are two ways of looking at it.

On the one hand, President Obama could be on the cusp of a remarkable victory. For more than two decades–ever since George H.W. Bush broke his “Read my lips, no new taxes” pledge in 1990 and unleashed a Republican civil war--not a single Republican in Congress has voted to increase tax rates, not even once. Anti-tax absolutism--even, or especially, as it relates to the wealthiest Americans--has become one of the most consistent, adamant planks in the GOP platform. That is the posture that Republicans took into the current negotiations. Obama kicked them off by demanding that the final deal include a rate hike on income over $250,000--something that would affect roughly the top 2% of wage-earners. House Speaker John Boehner immediately nixed this idea, and said Republicans would only agree to playing around with loopholes and deductions to raise new revenue--basically, the same plan Mitt Romney pushed during the campaign.

But Obama stood his ground, pointed out that he’d just run in a national election on his plan and been reelected, and even took his case back to the public with a series of campaign-style stops in the past few weeks. And guess what? It kind of worked. Republicans started speaking up--not in droves but in numbers not seen in decades--to say, yeah, the president has the leverage here; we’re going to have to give in here. That applies to John Boehner too. His latest offer to Obama calls for hiking rates on income over $1 million. So does his so-called Plan B. Obama now says he’ll settle for $400,000. If there’s a deal, it will be somewhere between these numbers--and no matter where it is, it will signal the end of 22 years of total, complete refusal by Republicans to even entertain the notion of a rate increase. That’s a pretty big deal--and an obvious win for Obama and Democrats.

But there’s another way of looking at this. What we’re arguing about here is the future of the Bush tax cuts, which were enacted all the way back in 2001, which blew a massive hole in the budget and helped create the deficits everyone’s now screaming about, and which Democrats have been railing against for 11 years. And yet, for all the drama and suspense, there wasn’t much separating Obama and the GOP from the start. He said he wanted the Bush rates extended for 98 percent of Americans. They said they wanted them extended for 100 percent. It looks like the compromise will end up covering 99 percent.

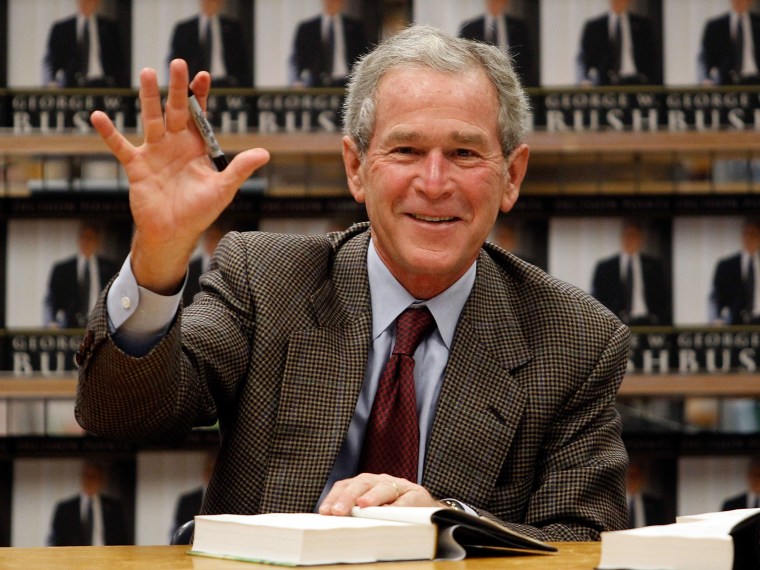

That’s right. For all of the noise we’ve heard about the Bush tax cuts, for all of the budgetary damage they’ve done, almost all of them are going to survive for good. I wouldn’t be surprised if somewhere in Crawford, Texas, a certain ex-president is smiling.