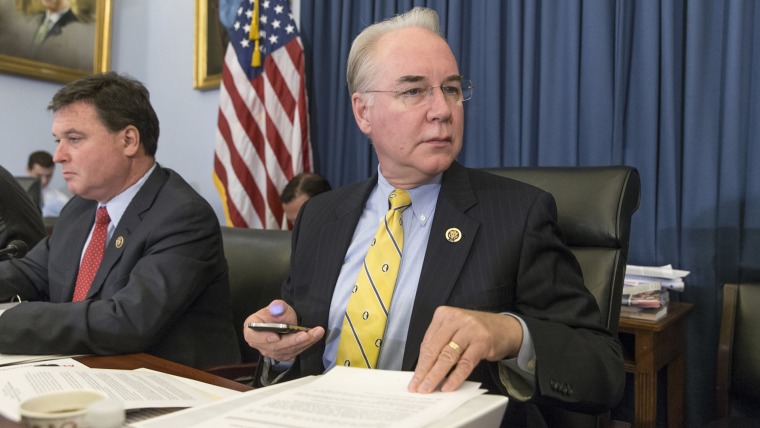

President-elect Donald Trump's pick to run the Health and Human Services Department traded more than $300,000 in shares of health-related companies over the past four years while sponsoring and advocating legislation that potentially could affect those companies' stocks.Rep. Tom Price, a Georgia Republican, bought and sold stock in about 40 health-care, pharmaceutical and biomedical companies since 2012, including a dozen in the current congressional session, according to a Wall Street Journal review of hundreds of pages of stock trades he filed with Congress.

Some of the specific examples are hard to overlook. For example, the Journal noted Price's investment in an Australian biomedical firm, Innate Immunotherapeutics, whose largest shareholder is Rep. Chris Collins (R-N.Y.), a Price colleague and a leading member of Donald Trump's transition team. In August, Collins bought four million shares in the company, and two days later, Price bought between $50,000 and $100,000 in the same company.A few months later, Congress passed the 21st Century Cures Act, which boosted investment in medical research, and sent Innate Immuno's stock higher, more than doubling in value since Price's investment.Richard Painter, an ethics lawyer in the Bush/Cheney administration, told Roll Call members of Congress should avoid actively investing in industries they oversee."Good judgment would be to stay out of health care stocks if you are on a health-care related committee," Painter said. "Stay out of energy stocks if you are on an energy committee. Stay out of defense stocks if you are on Armed Services."Price, who's benefited greatly from generous contributions from the health care industry, evidently feels differently.Naturally, as Kellyanne Conway told Rachel on Thursday's show, Price's investment strategies will be of great interest to Senate Democrats when his confirmation process begins in the new year, but I'm curious if Trump's transition team (a) knew about this and didn't care; or (b) never bothered to do any serious vetting of Price's background, looking for potential pitfalls.Remember, there's already evidence that the president-elect isn't overly concerned with due diligence when it comes to the vetting process. It's possible Team Trump had no idea that Price was investing in companies while sponsoring legislation that could affect their stock price.It's also possible that Trump and his aides knew and simply don't care about appearances -- because they expect the Republican-led Senate to confirm every cabinet nominee without too many questions.I'm not sure which scenario is more troubling.