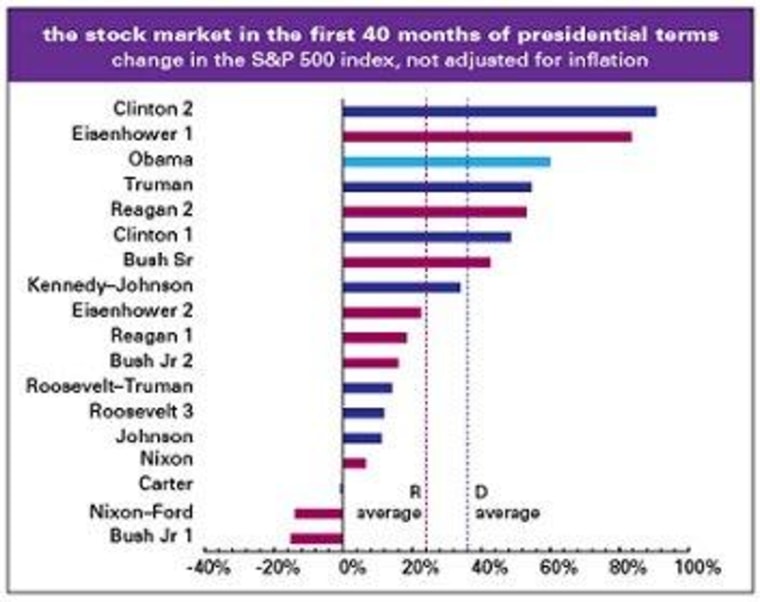

In February, we discussed an unmistakable trend: over the last half-century, the stock market has invariably performed better under Democratic administrations than Republican administrations. But Doug Henwood has taken this a little further, noting stock market gains over the first 40 months of presidential terms, going back 70 years.

As Henwood found, market performance under President Obama is the third best -- outpacing both of Reagan's terms -- and the average under Democratic presidents in general is considerably better than under Republican presidents.

In 2004, a Bush cabinet official said job creation and GDP numbers don't really matter because "the stock market is ... the final arbiter" of economic success. If that's still true, Republicans appear to have some explaining to do.

It also suggests Barack Obama is the worst socialist of all time. A soaring stock market, record high corporate profits, private sector job growth ... it's almost as if the president didn't listen to Karl Marx at all.

Regardless, most of the major players on Wall Street still detest the president. Why is that? Kevin Drum offers a compelling explanation.

First -- and there's no point in pulling punches here -- they're a bunch of spoiled brats. Over the past three decades they've gotten accustomed to the kind of deference normally offered to grand viziers of the Sublime Porte, and they're simply enraged at the fact that Obama not only doesn't seem very impressed by their accomplishments, but even criticizes them every once in a while. [...]Which brings us to the second thing: regulation. Like a lot of business people, I think they hate regulation more than they hate reduced profits. They'll fight higher taxes, but in the end, that's a pure money thing and they're accustomed to winning and losing money battles. But regulation wounds them far more. It's a signal that they aren't to be trusted. It's a reminder that someone else can tell them what to do. It makes it harder to earn money from purely financial manipulation.

Whether or not one believes the Democratic Wall Street reform efforts in 2010 went far enough, they were still the most sweeping regulatory reforms of the financial industry since the Great Depression, and they continue to enrage Wall Street professionals. That Mitt Romney has vowed to repeal all of these safeguards and layers of accountability, returning the system to the rules in place during the 2008 crash, has endeared him to the industry.