In June 2018, Larry Kudlow, the director of the Trump White House's National Economic Council, expressed his delight with the nation's fiscal landscape. Federal revenues, he insisted, are "rolling in," while the budget deficit "is coming down."

It wasn't coming down at the time, and it's certainly not coming down now. In the fiscal year that just wrapped up, as the Washington Post reported, the deficit hit $984 billion.

The U.S. government's budget deficit ballooned to nearly $1 trillion in 2019, the Treasury Department announced Friday, as America's fiscal imbalance widened for a fourth consecutive year despite a sustained run of economic growth. The deficit grew $205 billion, or 26 percent, in the past year.The country's worsening fiscal picture runs in sharp contrast to President Trump's campaign promise to eliminate the federal debt within eight years. The deficit is up nearly 50 percent in the Trump era. Since taking office, Trump has endorsed big spending increases and steered most Republicans to abandon the deficit obsession they held during the Obama administration.

The trend is likely to continue: the deficit will almost certainly top $1 trillion in 2020.

Circling back to our earlier coverage, these aren’t exactly the fiscal results Donald Trump promised the electorate before his election. As regular readers may recall, in February 2016, the future president appeared on Fox News and assured viewers that, if he were president, he could start paying off the national debt “so easily.” The Republican argued at the time that it would simply be a matter of looking at the country as “a profit-making corporation” instead of “a losing corporation.”

A month later, in March 2016, Trump declared at a debate that he could cut trillions of dollars in spending by eliminating “waste, fraud, and abuse.” Asked for a specific example, he said, “We’re cutting Common Core.” (Common Core is an education curriculum. It costs the federal government almost nothing.)

A month after that, in April 2016, Trump declared that he was confident that he could “get rid of” the entire multi-trillion-dollar debt “fairly quickly.” Pressed to be more specific, the future president replied, “Well, I would say over a period of eight years.”

By July 2016, he boasted that once his economic agenda was in place, “we’ll start paying off that debt like water.”

As Catherine Rampell recently explained, “Federal deficits have widened immensely under Trump’s leadership. This is striking not only because he promised fiscal responsibility – at one time even pledging to eliminate the national debt within eight years – but also because it’s a historical anomaly…. Trump’s own policies are to blame for this aberration.”

That’s plainly true. The White House and congressional Republicans swore up and down in late 2017 that they could slash taxes for the wealthy and big corporations without increasing the deficit because, as they repeatedly insisted, “tax cuts pay for themselves.” We didn’t need additional evidence that their ridiculous belief was, and is, wrong, but we have the evidence anyway.

As Paul Krugman added a couple of months ago, “[T]he Trump tax cut caused a huge rise in the budget deficit, which the administration expects to hit $1 trillion this year, up from less than $600 billion in 2016. This tidal wave of red ink is even more extraordinary than it looks, because it has taken place despite falling unemployment, which usually leads to a falling deficit.”

It’s an important detail. Every time we discuss the deficit, I feel compelled to point out again that I’m not a deficit hawk, and I firmly believe that larger deficits, under some circumstances, are absolutely worthwhile and necessary.

These are not, however, those circumstances. When the economy is in trouble, it makes sense for the United States to borrow more, invest more, cushion the blow, and help strengthen the economy.

The Trump White House and the Republican-led Congress, however, decided to approve massive tax breaks for the wealthy and big corporations when the economy was already healthy – not because they were addressing a policy need, but because they were fulfilling an ideological goal.

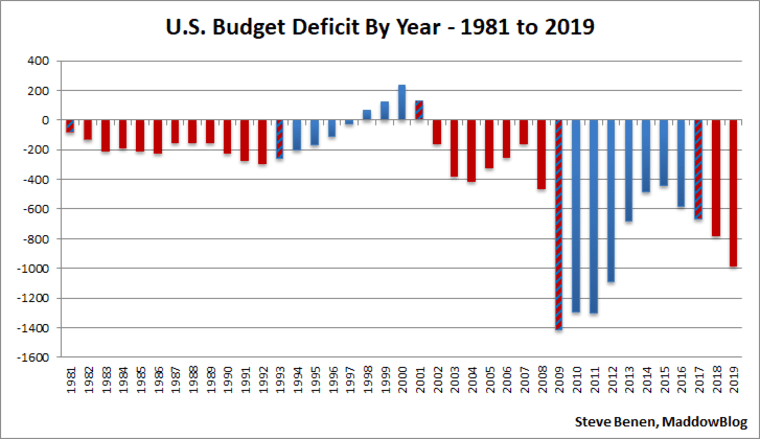

The results speak for themselves, though I put together the chart above to help drive the point home. Red columns point to Republican administrations, blue columns point to Democratic administrations, and red-and-blue columns point to years in which the fiscal year was split between presidents from two different parties.