There are perfectly sensible reasons to think yesterday's Senate votes on tax policy were more symbolic than substantive. But there's a political salience to the developments that shouldn't be overlooked too quickly.

The Senate, foregoing filibusters, held up-or-down votes on two competing tax plans: the Hatch/McConnell Republican plan, which would have kept Bush-era tax breaks in place for everyone, and President Obama's Democratic plan, which would extend tax breaks for all income up to $250,000.

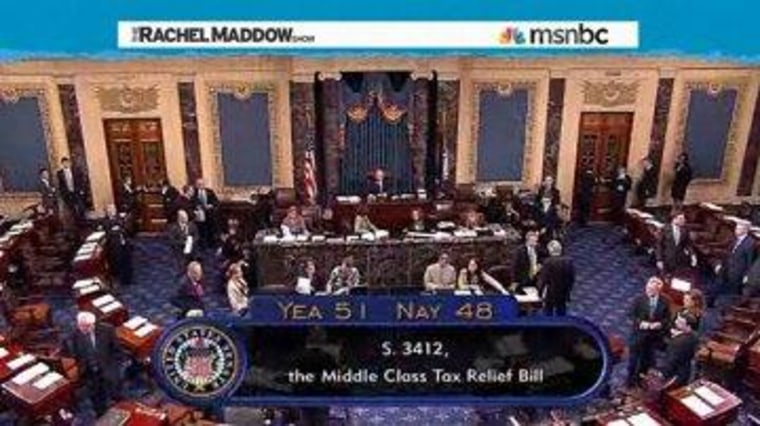

The GOP plan failed, garnering only 45 votes, but the Democratic proposal eked out a surprising win, 51 to 48, proving that Senate Majority Leader Harry Reid (D-Nev.) knows what he's doing.

As a legislative matter, tax bills have to start in the House, where the Democratic plan has no credible shot of passage. But as a strategic matter, yesterday's vote gives the president's party much-needed leverage going forward.

Remember, the GOP message is simple: protect the tax breaks for the wealthy or Republicans will force tax increases on everyone. If the president's plan had failed in the Senate, the takeaway would have been, "The White House agenda can't even pass a Democratically-controlled Senate, so Obama's plan is dead." Going into negotiations, the president would have been in a weaker position.

Instead, the opposite is true -- the pressure is now on House Republicans. Obama is on board with protecting middle-class tax breaks, and the Senate is on board with protecting middle-class tax breaks. Will the House GOP do the right thing, or will they let taxes go up? The burden has shifted.

What's more, there are two larger angles to appreciate: (1) Democrats appear confident their approach is the popular one; and (2) it's refreshing to see the Senate actually function for a change.

On the former, note that nearly every Democrat in the chamber, including every Dem who's up for re-election this year, backed the president's plan. Were they afraid of supporting a proposal that would allow taxes to go up on the wealthy "job creators"? Not even a little -- they've seen the polls and they correctly assume the American mainstream agrees with them.

Democrats have developed a reputation for buckling under these conditions, but this year, it's not happening. Republicans must find this unnerving, but they're increasingly faced with the likelihood that their latest hostage strategy will not work and Dems will not pay the ransom.

On the latter point, Mitch McConnell agreed to let both tax plans get up-or-down votes -- in other words, no filibusters -- because he simply didn't believe Democrats would stick together and pass Obama's proposal. McConnell gambled and lost, and Reid came out on top.

But the result was something truly remarkable: a Senate that operated by majority rule for one day, just as the institution was designed to function. Important proposals were allowed to come to the Senate floor, where senators were -- get this -- allowed to vote on whether they liked the proposal or not. If a majority approved, the bill passed.

In its own way, it was a rare and beautiful sight.

For his part, President Obama issued a statement after the vote, saying in part, "With the Senate's vote, the House Republicans are now the only people left in Washington holding hostage the middle-class tax cuts for 98% of Americans and nearly every small business owner."

Your move, Mr. Speaker.