Former President Bill Clinton spent much of a lengthy public policy lecture at Georgetown on April 30 defending his record on income inequality. According to Amy Chozick in The New York Times, Clinton feels somewhat aggrieved that this record hasn’t received more notice, even as Senator Elizabeth Warren, who some see as a potential primary rival to Hillary Clinton in 2016, has ridden the inequality issue to prominence.

“We had, when I was elected, already more than a decade of stagnant wages and a declining middle class standard of living,” Clinton said. “My commitment was to restore broad-based prosperity to the American economy, to give people a chance.” In that, he argued, he succeeded. “It drives me nuts when I read all these people saying, ‘ever since the 70s inequality has been growing.’ That’s not true.” The inequality trend stopped, Clinton argued, in 1995—his second year of office—only to resume under President George W. Bush.

Is that true? No. But Clinton did have a very strong record on income inequality—with one significant caveat.

Median income had indeed stagnated under Clinton’s two predecessors, Presidents Ronald Reagan and George H.W. Bush. Under Reagan there was substantial job growth (15.8 million), but the prosperity that began in 1983 and lasted halfway through 1990 (dubbed “the seven fat years” by Wall Street Journal editorialist Bob Bartley) wasn’t widely shared. Incomes for the poorest quintile (i.e., the poorest 20% of the population) rose, on average, by only 0.7% under Reagan, while incomes for the richest quintile rose, on average, by 23%. Under Bush, the country experienced net job loss and a drop in median income, thanks to the 1990-1991 recession and the weak recovery that followed. But the top quintile lost considerably less income, proportionally, than the bottom.

"The Clinton administration cared a lot about the middle class and the poor. But it also cared a lot—too much, in retrospect—about the rich."'

Clinton’s record was quite different, at least in part because there were no recessions during his two terms -- but also because he pursued very different policies, including a tax cut that was better targeted to middle incomes than Reagan’s, and a large increase in funding for both K-12 and higher education. This time, the prosperity was widely shared. “You can have all the economic growth in the world, “ Clinton said at Georgetown, “and if only ten people have it, you don’t get very much.”

Under Clinton, job growth was about 30 million -- the most since the 1970s. The poorest quintile gained 24%, which was slightly more than the richest quintile gained under Reagan. And under Clinton the richest quintile gained 20% -- slightly less than what the bottom quintile gained. Meanwhile, median income increased 17% -- the most rapid increase since the 1960s. Under George W. Bush, median income would fall again -- substantially more for the bottom quintile than the top quintile.

Weirdly, Clinton didn’t mention in his Georgetown speech his single greatest accomplishment in fighting inequality -- quadrupling the size of the Earned Income Tax Credit. (In discussing poverty, he was more interested in defending his 1996 welfare reform.) Even though top income tax rates are much lower today than they were when Ronald Reagan entered office, the federal income tax is, remarkably, slightly more progressive today than it was then -- thanks to tax relief and refundable tax credits provided to low-income people through the EITC. In his Georgetown speech, Clinton pointed out that 7.7 million people moved out of poverty during his eight years in office, compared to only 77,000 under Reagan.

Clinton didn’t say so, but his record in providing shared prosperity, in addition to being much better than Reagan’s or Bush’s, was also considerably better than President Obama’s. Median income today is 4% lower than it was when the recession ended six months into Obama’s first term. Job growth under Obama has been sluggish, as it was under George W. Bush. There was a large increase in the number of Americans living in poverty during the recession, and the poverty rate today stands at about 15% -- the highest it’s been since 2000.

With its Medicaid expansion, Obamacare may turn out to be the most equality-promoting policy enacted in a generation. But even if the 23 states currently refusing to participate change their minds, the gains for lower-income people won’t show up in income or employment data.

What’s the caveat? Where did Clinton fall down when it came to inequality? And why is it wrong to say that income inequality didn’t increase on Clinton’s watch?

To answer that, it’s necessary to explain that there are two kinds of inequality. What Clinton discussed in his Georgetown speech was the broad-based kind of inequality, measured in quintiles. He did not discuss a second kind of inequality, attributable mainly to the deregulation of Wall Street and out-of-control pay for top executives: the famous 1% versus the 99%.

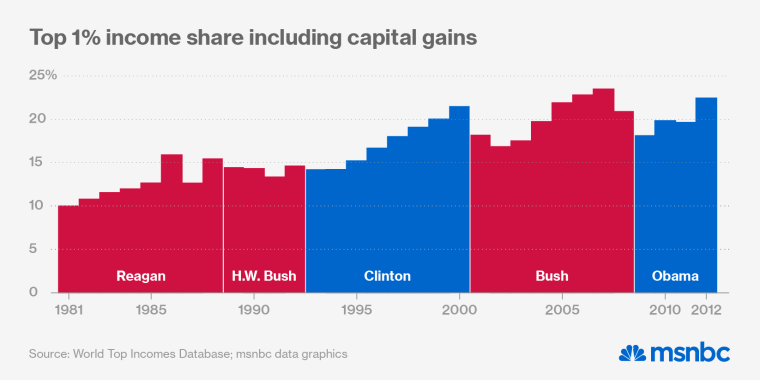

It is this “upper-tail” inequality that has grown fastest during the past two decades. And while income share for the 1% started growing in the late 1970s, it grew almost as fast under Clinton as it did under Reagan. During Reagan’s two terms, the 1%'s share of the nation’s income grew by half, from 10% to 15%. Under George H.W. Bush, the 1%'s income share stayed about the same. Under Clinton’s two terms, it grew by about one-third, to 21%.

The Clinton administration cared a lot about the middle class and the poor. But it also cared a lot—too much, in retrospect—about the rich. When Clinton came into office, capital gains were taxed at the same rate as regular income (thanks, interestingly, to a policy change that occurred under Reagan). But in 1996, Clinton lowered capital gains taxes. “I don’t know how many times I have read from the left bitter criticism about what a slug I was to sign the balanced budget act of’ 96 lowering the capital gains rate,” Clinton said at Georgetown. But, he added, “I would do it again tomorrow in a heartbeat.”

He would do it again, he explained, because it was the price the Republican opposition in Congress exacted in exchange for a large spending increase on education and creation of the Children’s Health Insurance Program. But no such gun was held to Clinton’s head when he extended two other gifts to Wall Street: the repeal of Glass-Steagall, which separated commercial from investment banking; and, when the chairman of the Commodity Futures Trading Commission, Brooksley Born, wanted to regulate derivatives, letting Robert Rubin conspire with Congress to crush the proposal.

Another boon to the rich enacted under Clinton was inadvertent. Campaigning in 1992, he’d pledged to limit tax-deductibility for executive salaries to $1 million. The aim was to halt the brisk rise in CEO pay. What Clinton didn’t foresee was that after the bill became law, corporations started giving top executives their raises in the form of stock options, which, because these corporations claimed not to know their ultimate value, were off the books (and therefore grew in even more unrestrained fashion). Because the stock options’ value rose and fell with the market more than as a result of the CEO’s stewardship, they were hard to defend on meritocratic grounds. The Clinton administration later compounded its error by resisting efforts in Congress to require that stock options be expensed. Arthur Levitt, chairman of the Securities and Exchange Commission under Clinton, later called it “the biggest mistake I made in my years at the SEC.” Stock-option expensing eventually became mandatory under George W. Bush, as a result of the Enron scandal.

President Obama has been more willing to stand up to Wall Street—for example, by signing the Dodd-Frank financial reform law. But in fairness to Clinton, the results so far haven’t been all that different. According to Berkeley economist Emmanuel Saez, between 2009 and 2012, the most recent year for which data are available, incomes grew 31% for the top 1% and 0.4% for the bottom 99%. The 1% has captured fully 95% of the economic recovery. That’s a situation that will be hard for any president who might follow Obama—including Hillary Clinton—to turn around.