The first post-election steps have been taken toward a possible deal that would avert the so-called "fiscal cliff" and instill some much-needed certainty to the markets and the economy.

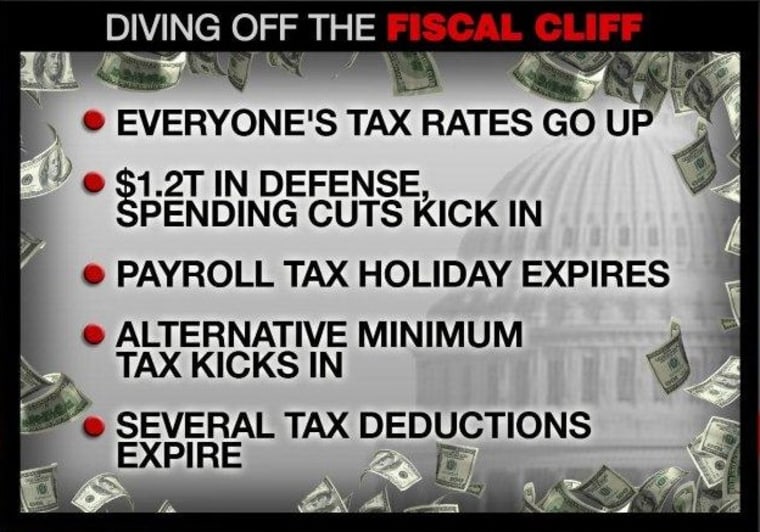

Friday's White House meeting between President Obama and congressional leaders from both parties comes just 46 days before tax rates are set to rise and automatic spending cuts kick in.

If there's no deal beforehand, National Journal's Jim Tankersley said, "it's probably not terrible but the longer it persists, the higher the chances are of another recession."

Greg Ip, U.S. economics editor for The Economist, told The Daily Rundown's Luke Russert, the market is assuming there's some sort of a deal before Jan. 1 and if not, "the market is not ready for that."

President Obama is calling for a deal now to prevent tax rates from going up on the middle class, telling reporters Wednesday, "we could get that done next week." But a short-term deal that doesn't deal with issues like spending and tax reform may not be what the leaders have in mind.

Senate Majority Leader Harry Reid (D-NV) said last week, he's "not for kicking the can down the road." House Speaker John Boehner (R-OH) indicated he hoped to make progress during the lame duck session of Congress so that "2013 is finally the year that our government comes to grips with the major problems that are facing us."

Of course, conciliatory words don't necessarily translate into political compromise. Nevertheless, there is still talk of a potential grand bargain that would mix tax and entitlement reform in a manner that could offer the country a more sustainable fiscal path over the next decade and beyond.

"If we're looking at freeing up investment, freeing up hiring over the medium- and long-term, the markets would love that," said Tankersley.

Ip agreed: "A grand bargain...would be a huge confidence builder. You would see the market rally on that."