There's no great mystery surrounding the purpose of the Consumer Financial Protection Bureau. The goal of the agency is spelled out in its name: it's a bureau that exists to protects the financial interests of consumers.

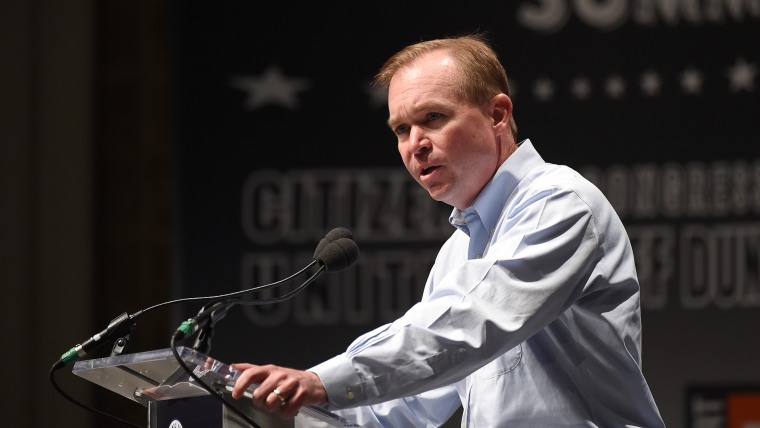

At least, it did. For now, Donald Trump has put Office of Management and Budget Director Mick Mulvaney in charge of the CFPB -- despite (or perhaps because of) Mulvaney's stated belief that the agency shouldn't exist. As expected, the far-right Republican wasted little time in overhauling the CFPB's mission statement to make it more bank-friendly.

Yesterday, as the New York Times reported, Mulvaney sent a letter to the agency's employees, outlining a new vision that downplays the importance of consumers' interests.

Mr. Mulvaney made clear that under his direction, the consumer bureau would be more reluctant to target companies without overwhelming evidence of wrongdoing and suggested that the effect on a business should be weighed more heavily when considering cracking down on potential consumer abuses. [...]Mr. Mulvaney also said that the bureau would introduce more quantitative rigor in determining which companies to target for enforcement, a move sure to be welcomed by banks and financial trade groups that have complained about the agency's enforcement approach.

"We are government employees," Mulvaney wrote. "We don't just work for the government, we work for the people. And that means everyone: those who use credit cards, and those who provide those cards; those who take loans, and those who make them; those who buy cars, and those who sell them. All of those people are part of what makes this country great."

Or put another way, the OMB chief appears to be confused. He's leading an agency that is supposed to have a sole focus on the financial interests of consumers -- again, it's literally right there in the name -- and expanding that focus to include everyone else, including those who may be actively working against consumers' interests.

Worse, we don't have to wait to see the manifestation of Mulvaney's regressive vision for the CFPB. Slate's Jordan Weissmann explained yesterday, "Last week, the CFPB dropped a lawsuit in Kansas against four payday lenders without any explanation, other than a weak assurance that it would continue investigating the case. Meanwhile, International Business Times reports today that Mulvaney stealthily closed an investigation into a South Carolina-based payday lender, World Acceptance Corporation, which had previously donated to his campaigns."

That's really just a sampling. Last week, the current CFPB chief also announced plans to scrap Obama-era safeguards imposed on payday lenders.

Those who thought Trump and his team were serious about championing the interests of the "forgotten" working class fell for a scam worthy of CFPB investigators.