It's rare when a series of errors in an economic paper generate national attention. Then again, it's rare when an economic paper does as much as damage as the report Carmen Reinhart and Kenneth Rogoff published a few years ago.

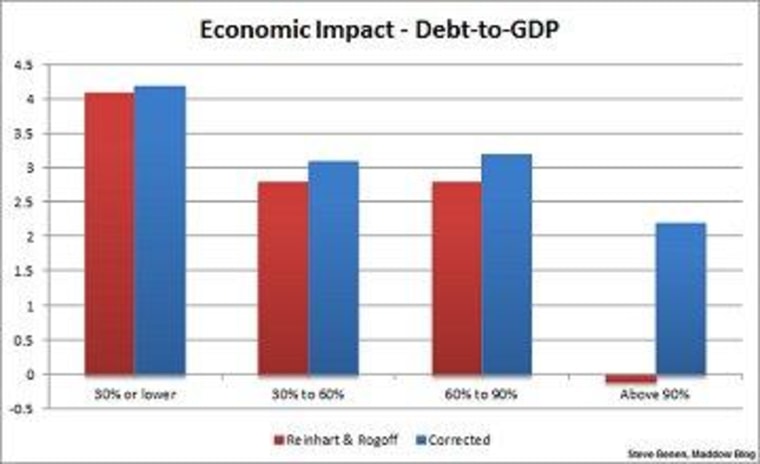

By now, you're probably familiar with the story. The Reinhardt/Rogoff study effectively made a straightforward observation: there's not only a relationship between a nation's debt level and its GDP, there's also a tipping point. When a nation's debt climbs above 90% of the nation's total economy, it necessarily serves as a drag on economic growth.

The Reinhardt/Rogoff study was immediately embraced by Republican policymaker at the highest levels, and became the intellectual foundation for a destructive austerity agenda.

The problem, we now know, is that Reinhart and Rogoff made some important errors in their research, including a careless mistake in an Excel spreadsheet. The economic research embraced by conservatives everywhere was faulty, and a national controversy ensued -- including a brutal segment on "The Colbert Report."

Reinhart and Rogoff, hoping to stem the tide of criticism, published an item last week defending their work. The response was unkind -- Paul Krugman described their defense as "really, really bad" and "terrible."

So today Reinhart and Rogoff try again, writing an item for the New York Times. The gist of the piece is that their error-laden study was misused by partisan opportunists on the right and therefore not entirely their fault.

Nowhere did we assert that 90 percent was a magic threshold that transforms outcomes, as conservative politicians have suggested. [...]Our view has always been that causality runs in both directions, and that there is no rule that applies across all times and places.... Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists.

Or put another way, "Who, us? Tipping point? 90%? This has been a big misunderstanding!"

It's a spirited effort, which remains unpersuasive.

Matt Yglesias' take rings true.

[T]he fact is that this isn't just some sad case of conservative politicians running around mischaracterizing a sober-minded study and then liberals overreacting in response. Ken Rogoff was writing op-eds drawing strong policy conclusions from this paper. He was delivering congressional testimony drawing strong policy conclusions from this paper. And it's not as if he's some political naif who stumbled down from the ivory tower into a partisan controversy he could never have predicted. He was research director at the International Monetary Fund and he knows how the game is played. He's signed up as a paid speaker for the Washington Speakers Bureau.His "fees vary based on event location" but they promise that in exchange for your money "Kenneth Rogoff reaches beyond the theoretical and delivers quantitative proof from his frequently cited research and best-selling book to explain why our financial history continues to repeat itself-and just where the US and global economies are heading."

Reinhart and Rogoff haven't even tried to defend to defend their errors in earnest, instead relying on a curious don't-blame-us-for-being-misunderstood defense.