With fundraising totals reaching extraordinary heights, there's no doubt that both President Obama, Mitt Romney, and their assorted allies will have plenty of resources between now and Election Day.

But it's worth noting that while neither side will suffer from empty coffers, there's a clear qualitative difference in the kind of donors that separate one campaign from the other. The Boston Globe had an interesting report on this the other day.

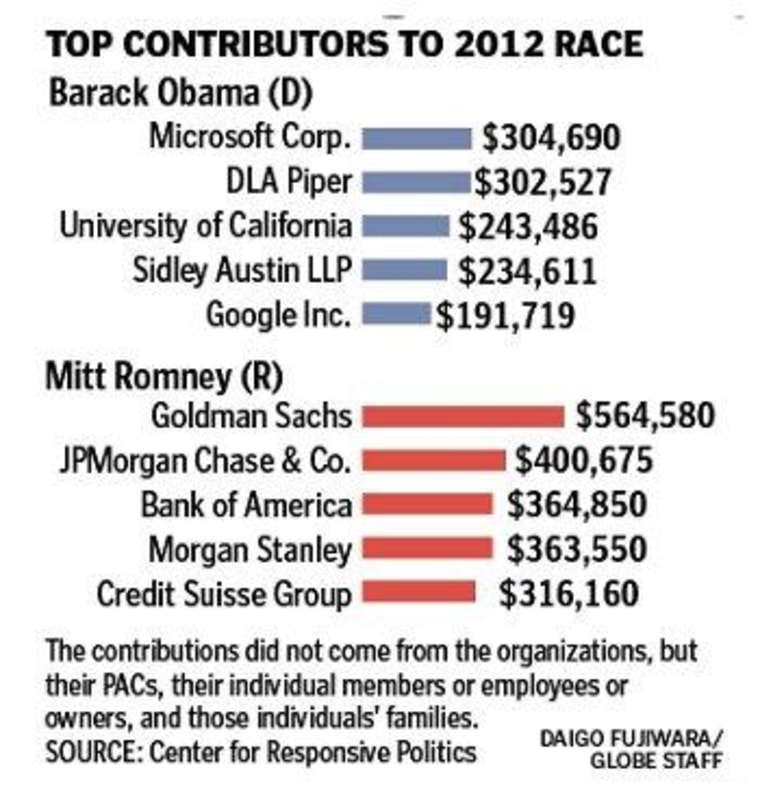

When the head of JPMorgan Chase met with shareholders to answer for a trading loss of more than $2 billion Tuesday, it was against an evolving political backdrop: Donors from big banks are betting on Mitt Romney to defeat President Obama and repeal new restraints on risky, large-scale investments."There's no doubt that there's been a big diminution of support for the president,'' said William M. Daley, Obama's former chief of staff and a former top JPMorgan Chase executive. "People in the financial services sector are saying, 'The president has been too tough on us, both in policy and on rhetoric.' ''The top five donor groups in Romney's campaign are individuals and political action committees associated with large financial institutions, led by Wall Street giants Goldman Sachs and JPMorgan Chase, according to information compiled by the Center for Responsive Politics, a nonpartisan research group that tracks campaign donations.

While in 2008, financial institutions were far more inclined to back the Democrat, those contributions have seen a sharp decline. The most generous contributors to Obama's re-election campaign include exactly zero Wall Street backers: the top donor groups include individuals and PACs affiliated tech giants (Google and Microsoft), law firms, and academia.

Why does this matter? For one thing, for voters who care about such things, Romney's overwhelming support from Wall Street could prove to be politically problematic -- just four years ago, these financial institutions' recklessness and mismanagement nearly destroyed the global economy. Wall Street is not at all popular with the American mainstream, so being known as Wall Street's candidate isn't exactly a selling point.

For another, these generous contributions do not occur in a vacuum -- if Romney's elected, he'll pursue a policy agenda intended to make these Wall Street donors very happy.

Indeed, consider what the presumptive Republican nominee said just last week about JPMorgan's latest bad bets, which cost at least $2 billion: "This was a loss to shareholders and owners of JPMorgan and that's the way America works. Some people experienced a loss in this case because of a bad decision. By the way, there was someone who made a gain."

The point of the argument was simple: there's no need for safeguards or layers of accountability to protect the integrity of the system; it's better for government to just get out of the way and let his Wall Street supporters do as they please. The market, the argument goes, will work itself out.

Paul Krugman, referencing an example he discussed on the show on Friday, explained today how misguided this is.

[S]uppose that someone -- say, Jimmy Stewart in the movie "It's a Wonderful Life" -- runs a bank that takes in deposits and invests the money in various ways. And suppose that one of those investments is a risky bet on some complex financial instrument, with Mr. Potter, the evil plutocrat, on the other side.If Jimmy Stewart's bet pays off, we're in Romneyworld: he's made money, Mr. Potter has lost money, and that's that. But suppose Jimmy Stewart loses his bet. If the bet was big enough, he no longer has enough assets to pay off his depositors. His bank collapses, probably in a chaotic bank run that takes down the whole town's economy as collateral damage. Mr. Potter makes money on the deal, but so what?The point is that it's not O.K. for banks to take the kinds of risks that are acceptable for individuals, because when banks take on too much risk they put the whole economy in jeopardy -- unless they can count on being bailed out. And the prospect of such bailouts, of course, only strengthens the case that banks shouldn't be allowed to run wild, since they are in effect gambling with taxpayers' money.Incidentally, how is it possible that Mr. Romney doesn't understand all of this? His whole candidacy is based on the claim that his experience at extracting money from troubled businesses means that he'll know how to run the economy -- yet whenever he talks about economic policy, he comes across as completely clueless.

Whether Romney is actually clueless or simply taking positions that coincide with the financial institutions that are bankrolling his campaign is unclear.