Whatever the answer, it's clear that businesses have grown much more wary of new investments recently, and the clearest evidence of that has emerged in the last two quarters. Much of the recent downturn in business spending is a result of much lower prices for oil, metals and other commodities, and fears of a slowdown in China and elsewhere around the world that are putting a crimp on investment opportunities.

"It doesn't look like there's any danger of recession, but the global economy and commodities are weak," Kevin Logan, chief United States economist at HSBC, told the Times. "The global commodity shock has affected growth in the U.S. in a way that was unexpected, especially in terms of the energy industry."

It's worth noting that this morning's total is a preliminary estimate that will be revised twice more in the coming months. Whether it's revised up or down remains to be seen.

Marketwatch reported that most economists believe today's discouraging data "is unlikely to carry over in the spring." New York magazine added, "While it's possible that these are the first signs of a looming recession that will propel Donald Trump to the Oval Office and America to its untimely death, there are several reasons to be bullish about the economy's near-term prospects."

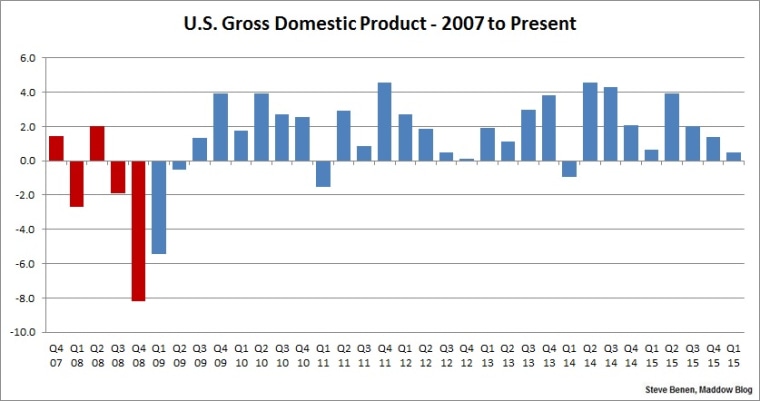

As for the image above, the chart shows GDP numbers by quarter since the Great Recession began. The red columns show the economy under the Bush administration; the blue columns show the economy under the Obama administration.