Traditionally, when the economy isn't where it needs to be, policymakers have pushed for various forms of stimulus -- the right has preferred monetary stimulus from the Fed, while the left has preferred fiscal stimulus from Congress. When the economy is in especially dire straits, ideally we'd see both efforts simultaneously.

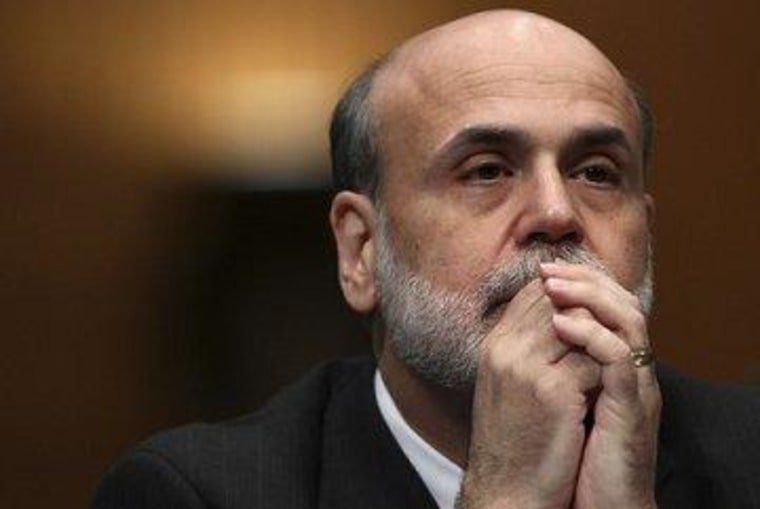

In 2012, that's a problem. As the Republican Party has moved sharply to the right, it now opposes monetary and fiscal stimulus, abandoning what was conventional thought among conservatives for decades. But as Matthew O'Brien explains, Federal Reserve Chairman Ben Bernanke, himself a Republican, still wishes GOP policymakers would wake up and smell the need for fiscal intervention.

It might not look like it, but forecasting sub-2 percent inflation nowadays is the Fed's way of begging Congress to borrow more. That's the big implication of the Fed's big policy moves the past few months. The Fed is already buying $85 billion of bonds a month on an open-ended basis and has promised not to raise rates before unemployment falls below 6.5 percent or inflation rises above 2.5 percent. But it still thinks inflation will remain subdued, despite its bond-buying.In other words, the Fed is telling us it will tolerate a bit more inflation, but it won't create it. That's as good an invitation as Congress is going to get to cut taxes or increase spending, at least until inflation is around 2.5 percent.

O'Brien didn't mention it, but it's worth noting that Bernanke, over the last couple of years, has occasionally abandoned subtly and explicitly pleaded with Congress to consider fiscal stimulus, but Republicans have always refused. Indeed, GOP lawmakers haven't just been content to ignore the need for fiscal remedies, they've also demanded that Bernanke stop trying to improve the economy through monetary measures.

For much of the last two years, it seemed at least possible that Republicans hoped for a weaker economy in the hopes that it would undermine President Obama's chances for re-election. But since GOP policymakers continue to oppose efforts to improve economic growth, it's also worth considering the notion that Republicans simply haven't the foggiest idea what they're talking about.

A fragile recovery is underway, and it is within Washington's power to make it a robust one. The federal government can borrow money for free, invest in job creation, and inject capital into the economy to strengthen demand, all while enjoying the benefits of quantitative easing, low inflation, and zero percent interest rates.

This is a textbook case for expansive public investment. So what is Washington doing? It's debating austerity measures.

Bernanke wants Congress to act as a partner, working with him to strengthen the economy. Instead, it's acting as a rival, pushing in the wrong direction.