The bipartisan infrastructure bill the Senate passed Tuesday will, among other things, help upgrade America’s water systems and highways. Oddly, though, in the days leading up to its passage, about the only provision in the bill people were arguing about didn’t involve roads or bridges. Instead, it had to do with, of all things, cryptocurrency.

The provision in question is supposed to help pay for the bill by raising $28 billion over 10 years from taxes on crypto transactions. But its more significant function will be to expand the government’s ability to trace and track crypto transactions and bring crypto more fully under the financial regulatory umbrella. In that sense, it’s a testament to cryptocurrency’s growing importance. But the fight over the bill shows something else, too: how tricky it’s going to be for the government to regulate a financial technology designed, in a lot of ways, to avoid regulation.

The clash over crypto in the Senate was all about the meaning of a single word: “brokers.” The bill as passed defines a broker as anyone who provides “any service effectuating transfers of digital assets on behalf of another person” and requires brokers to complete 1099 tax forms for their customers (which means, obviously, they need those people’s names, addresses and Social Security or tax ID numbers).

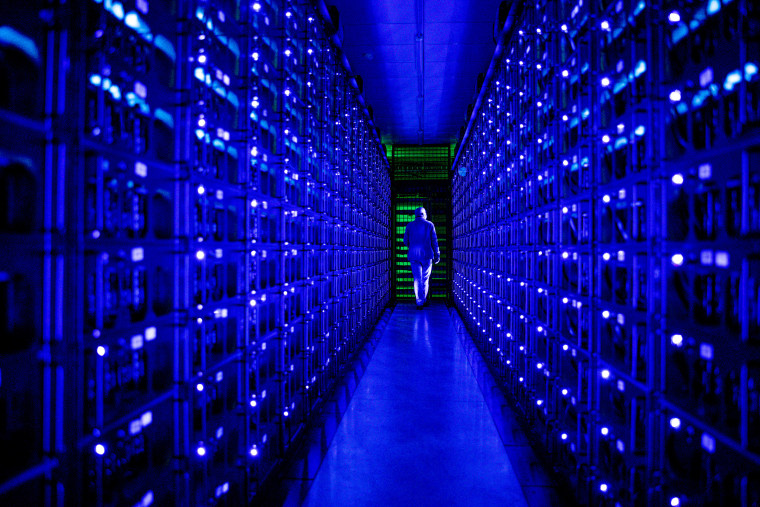

The crypto brokers the bill’s authors had in mind were platforms like Coinbase, which people use to buy and sell crypto assets. But the definition is broad enough that it could also include software developers and even the crypto miners who confirm and verify blockchain transactions, since they all provide services that help transfer crypto assets. Miners, though, don’t have access to their users’ information, which would make it impossible to fill out a 1099 for them.

The clash over crypto in the Senate was all about the meaning of a single word: “brokers.”

Crypto advocates recognized this was a problem and lobbied the Senate to amend the provision. Initially, two competing bipartisan amendments emerged. One — backed by the White House — would have exempted traditional cryptocurrency miners, those working in what are called “proof of work” systems like Bitcoin and Ethereum 1.0, from the reporting requirement. The other — sponsored, interestingly, by liberal Sen. Ron Wyden, D-Ore., and two Republicans — would have exempted all miners, including those working in what are called “proof of stake” systems used by a lot of newer cryptocurrencies, as well as software and protocol designers and developers.

Wyden’s proposal was the better one, since exempting only proof-of-work miners would have effectively meant the government was picking winners, giving one form of crypto technology (and a very energy-intensive one at that) tax advantages over others. And ultimately, the two sides reconciled and came up with an amendment that would have exempted anyone involved in validating blockchain transactions, whether via proof-of-work or proof-of-stake, from having to file 1099s.

This was a reasonable compromise. But it was all for naught. The senators left it so late that the only way they could get the provision into the bill was via unanimous consent, meaning every senator had to agree to include it. Sen. Richard Shelby, R-Ala., twice attempted to tack on defense funding to the amendment, and having been twice rebuffed, he objected to the provision. And so the bill passed with its original, expansive definition of “broker” intact.

Now, if you’re not a crypto enthusiast, this was a pretty esoteric argument. (And the argument isn’t even over: The Treasury Department, which will be in charge of implementing the provision, will have the authority to write rules clarifying who does and doesn’t count as a broker.) But there are some important points the fight helped illuminate.

First, it shows how challenging and contentious even simple things like recording people’s names and addresses — which we take for granted in every other part of the financial system — are in the world of crypto. What senators were arguing about, after all, wasn’t whether miners should be required to pay taxes but whether they should be required to collect information from users (who, to be fair, will have to pay taxes), or — as crypto advocates critical of the bill put it — whether they should be required to “surveil users.” The entire U.S. tax and regulatory financial system is built on surveilling users, and most of us think nothing of it. But for many crypto enthusiasts, that’s an intolerable invasion of privacy.

Now, in the short term, this won’t be a huge deal because most crypto transactions in the United States consist of people trading cryptocurrencies back and forth, and lots of crypto users prefer to use traditional brokers like Coinbase, which makes transactions easy for the government to track. But lots of people believe that a big part of crypto’s future is as a foundation for decentralized finance, or DeFi. Already people are building financial systems, running on the Ethereum network, that include a host of tools that mirror the traditional financial system without running through centralized exchanges. And that presents a much bigger set of challenges for the federal government.

The whole promise of DeFi is that it's not inside the system and not centralized. It’s designed to work without brokers or banks and to work without government setting the rules of the road. In other words, it’s designed to be difficult to monitor and regulate. So the fight we saw over the past week feels like little more than a trial run of a much bigger argument over what DeFi regulation should look like. It’s still not obvious that DeFi offers enough advantages to ordinary users to ever really take off. But if it does, the struggle to track, tax and regulate it will make the battle over Bitcoin miners filing 1099s look trivial.