Friday at 8:30am, the Bureau of Labor Statistics will release its employment report for October. Jobs days are always big news, of course, and this one is the last big economic number to come out before next Tuesday’s election. So I’m gonna go out on a limb here and say it will not go unnoticed.

What to expect? The consensus guesstimate—basically an average of all the forecasters who try to figure out what the report will show—is for employment growth of 125,000 and the unemployment rate to tick up slightly to 7.9%. That’s about the same as last month (in September, employment was up 114,000 and unemployment fell to 7.8%.)

A report out this morning on private sector job growth from the payroll firm ADP finds 158,000 jobs gained in October. But in any given month ADP reports often diverge from the official stats. Note also that the impact of Sandy will not be seen in this report, because the data were collected well before she (he?) hit.

Anyway, if the expectations are about right—and the consensus forecast, while generally in the ballpark, can also be way off any given month—it will be a status-quo report, basically on trend with recent data. That shouldn’t have much impact on either economic or voting markets.

In fact, anyone waiting to decide their vote based on tomorrow’s jobs report should very quickly and very thoroughly reconsider. A very good or very bad report will by definition be an outlier that has a good chance of being revised back to trend in a later report based on more complete data. Not to mention that judging a president’s performance based on one monthly jobs report is…how can I put this kindly?…freakin’ nuts!

Given statistical noise, that’s just the way these monthly reports have to be treated. And before partisans get excited here, a few points:

• I’ve been reporting on these jobs data every month for years and I’m constantly stressing the importance of averaging over numerous months to get the trend.

• The confidence interval for the jobs data is 100,000; for the unemployment rate, it’s 0.2 percentage points. This means that when a job gain of 125,000 is reported, the actual number has a 90% chance of being between 25,000 or 225,000. It means a tick-up in unemployment from the current level of 7.8% to 7.9% is statistically indistinguishable from no change at all.

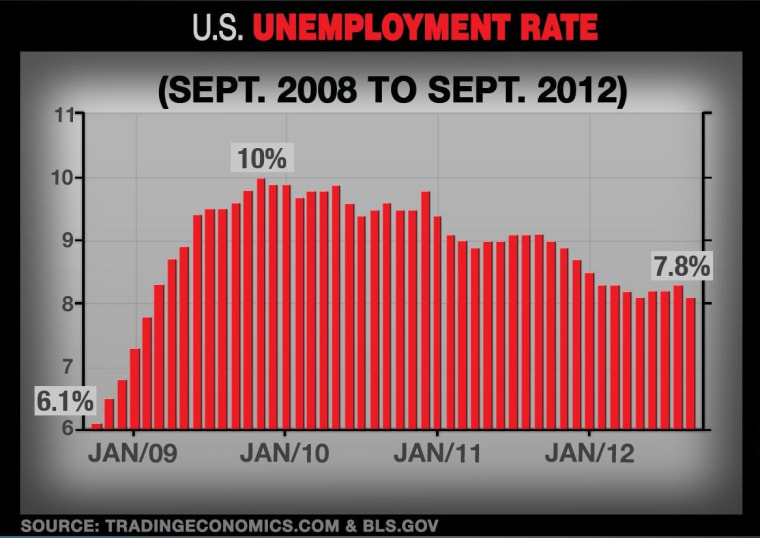

If you follow this stuff, you probably recall that last month, the unemployment rate fell significantly (and I mean that both in a statistical and political sense) from 8.1% to 7.8%. With the election a few weeks away, crossing the 8% threshold was obviously a big deal. But I and others stressed that the jobless rate, which was driven by an outlier job growth number from the unemployment survey, could easily bump back up to 8% in tomorrow’s report.

Wouldn’t that mean the job market was worsening? Probably not, at least not unless the next few months of data corroborated the uptick.

So, bottom line, we’re expecting a status quo report showing the job market is slowly improving, which would be consistent with other indicators showing the economy consistently expanding at a steady, if sloggy, growth rate.

There are, of course, things we could and should do to accelerate the pace of job growth, ideas like those proposed by the president over a year in the American Jobs Act. But Congressional conservatives remain stuck in the joint mode of a) blocking any good ideas from Democrats and b) convincing themselves that fiscal austerity will magically start working very differently than it has in Europe, where unemployment just hit a record high 11.6%.

So, stay tuned—I’ll try to post some quick analysis on my blog shortly after the report is released at 8:30am (I say “try” because I’m commenting on the numbers on CNBC at 8:40). But given the caveats above and the tendency to over-amplify the significance of these numbers even in a normal month, I’ll be trying not to get too excited no matter what they show. I urge you to do the same.