Is greater access to college education the solution to income inequality?

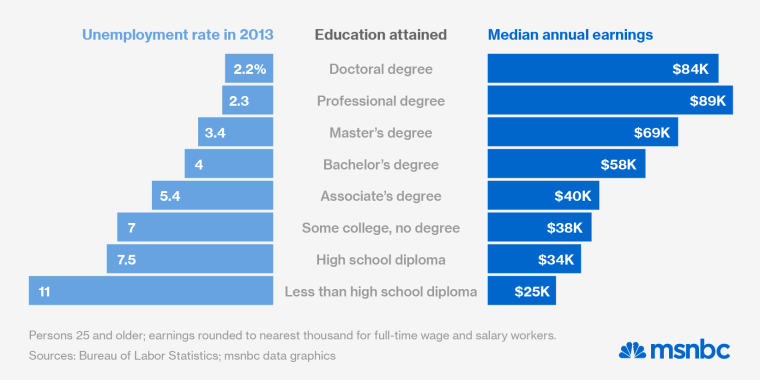

First, let’s get one matter out of the way: If you happen to be a graduating high school senior, go to college if you can. As David Leonhardt explains in The New York Times, “Yes, college is worth it.” The “college premium” -- the average income difference between those who have a college degree and those who do not -- has never been larger.

But it’s stopped growing.

Before we proceed, a bit of background. The rise in income inequality since 1979 isn’t one divergence but two. One of these is a growing disparity between the top 1% of the income distribution and the bottom 99%. The other is a growing disparity between those who possess a college or graduate degree and those who do not.

"Yes, the college premium has never been larger, but increasingly it measures not so much rising income among college grads as falling income among mere high school grads."'

Lately, the 1% type of inequality has been getting most of the attention -- including in Thomas Piketty's new book, "Capital in the Twenty-First Century." That’s because in recent years the 1% type has been increasing more dramatically. It’s also much easier to identify the causes of the rapid growth in the income share for the 1% (really, the top 0.1%): deregulation on Wall Street and an out-of-control upward spiral in pay packages for top executives. To the extent that any discussion of inequality finds fault with the winners, criticizing the top 1% of the population is always going to be more popular than criticizing the top 10% or 20%.

Some commentators, Piketty included, suggest that the income disparity between people with postsecondary degrees and those who lack them is unimportant. Since 1970, the “overperformance” of the top 1%, Piketty writes," “explains most (nearly three-quarters) of the increase” in the top 10%'s rising share of U.S. national income. Piketty concedes that investment in education and skills is the best way to reduce inequality over the long term, but he also writes, “there is no evidence that education has really increased intergenerational mobility.”

But to judge from the college premium, educational attainment matters quite a lot -- to inequality, and likely to mobility as well.

Yes, the college premium has stopped growing. But before it stopped it grew quite a lot starting in the early 1980s. The magnitude of that growth, MIT economist David Autor writes in the May issue of Science, was “four times as large as the redistribution that has notionally occurred from the bottom 99% to the top 1% of households.” A similar skills-based wage gap opened up in many comparable nations, but nowhere to the same extent as in the U.S., where average earnings for college graduates rose, according to Autor, from 1.5 times those of high school graduates in 1982 to twice those of high school graduates in 2005.

Exactly when the college premium stopped increasing is a matter of some dispute. But the growth appears to have halted at least nine years ago. Autor says it stopped in 2005 because between 2004 and 2012 “the supply of new college graduates to the U.S. labor market rose at a rate not seen in several decades.”

But there’s some evidence the college premium stopped its upward climb even before 2005. Some of Autor’s own data suggest the halt actually occurred around 2000; note the flattening of the top line here. And using different data, Lawrence Mishel, president of the Economic Policy Institute (EPI), a left-leaning nonprofit, says the college premium stopped growing in 1995, even as the economy was picking up speed. “It is implausible,” Mishel says, “to believe that education has played a major role in the wage gap between high-wage and middle-wage workers since the 1990s.”

If the college premium hasn’t been a driver of broad-based income inequality since 2005 (or 2000, or 1995), what has? One possibility is that today’s “skilled worker” is no longer a college graduate but someone who possesses an advanced degree. Just as the high school premium of the early 20th century gave way to the college premium, perhaps the college premium has given way to the grad-school premium. If true, that will pose a considerable challenge to policymakers. Boosting the college completion rate is difficult enough; how can any but a small segment of the population ever hope to put itself through graduate school as well?

The more immediate problem, though, is slack demand for college graduates. Yes, the college premium has never been larger, but increasingly it measures not so much rising income among college grads as falling income among mere high school grads. Autor attributes the latter to automation, globalization, and the decline of unions. Hourly wages for college graduates, the Times’s Leonhardt points out, have risen only 1% over the past decade. For recent college graduates (ages 21-24), it’s much worse: Hourly wages have actually fallen by 7.7% since 2000, according to EPI. The decline has been steeper (10.8%) for young high school graduates (ages 17-20). But in an economic recovery, aren’t wages supposed to go up, not down?

A final burden for today’s college graduates is the truly alarming rise in student debt. Just between 2004 and 2012 -- a mere eight years -- it tripled, to $966 billion. The number of borrowers increased by 70% and the average balance per person increased 70% as well. Meanwhile, the percentage of borrowers past due on loan payments (i.e., by more than 90 days) rose from about 10% to about 17%. Those rising stakes mean harsher consequences for students who drop out before completing their degree or can't find a job, even as the system's winners garner ever-greater financial rewards.

So yes, college graduates: The benefits of a college education have never been greater. But only in comparison to the people who lack one. Compared to the folks who collected college diplomas in years past, the picture isn’t very cheery at all.