European leaders are set to meet this week to discuss the euro zone and how to best encourage economic growth in the euro zone. Morning Joe financial analyst Steve Rattner brings charts to discuss the economies of countries like Germany, Italy and Portugal.

And here are those charts along with some quotes from Rattner:

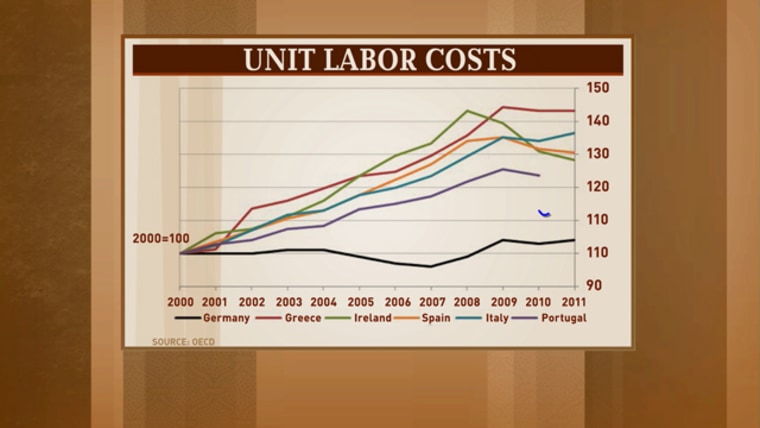

It’s not as simple as austerity vs. growth…It gets to the heart of the economies in Europe and the performance of them. What you see in the first chart is the enormous divergence in what we call unit labor costs or how efficient the economy is: What do workers get paid? How much do they produce? Sort of that combined together. So over the last ten years, you see that Germany, which is the black line at the bottom, has been bumping along and has just barely grown its unit labor costs because they’re very productive and their workers have not gotten huge pay increases. But if you look at the countries that are now in trouble – Spain, Italy, Portugal, and Ireland – you see a different picture.

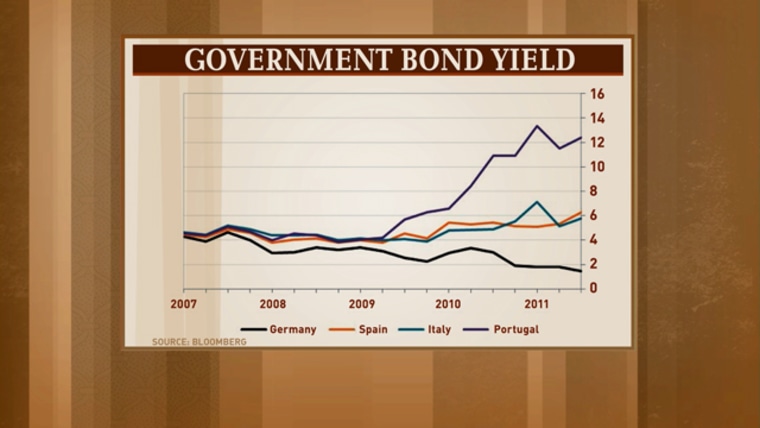

If you go back into the 2006-2009 period, the debt of all these countries traded at about the same level. The market did not distinguish; they assumed they were all part of the euro…But then the market sort of woke up and said these are not the same countries anymore.

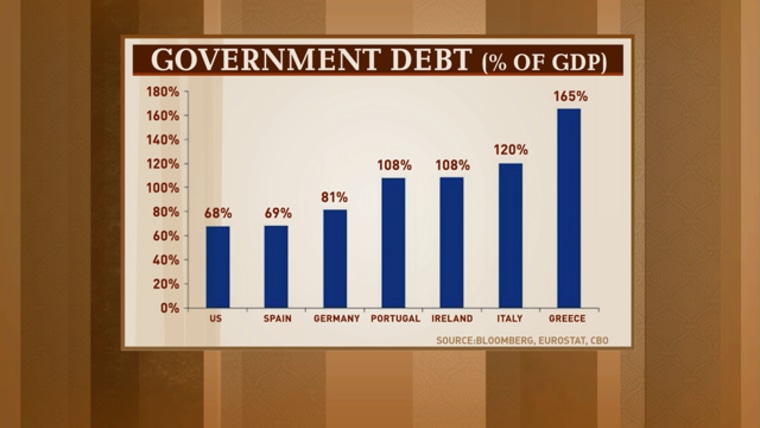

Our deficit is 8.2% of GDP, Spain 8.5%, Portugal 4.2%, Italy 3.9%. So we are in the same place as they are in terms of having to deal with our deficits.

We have lower debt to GDP than these countries. These countries are all over 100 percent. We still have not crossed the Rubicon in terms of having too much debt but our deficits are too high.