As states start to reopen their economies, many of us will be reopening our wallets as well.

If you’ve been staying home, you likely haven’t been spending as much as you normally would. According to the Bureau of Economic Analysis, personal consumer expenditures decreased by 13.2 percent from March to April. And personal savings rates are at an all-time high of 33 percent, up over 25 percentage points since January.

But now that the economy is beginning to re-open, there is a risk of overspending.

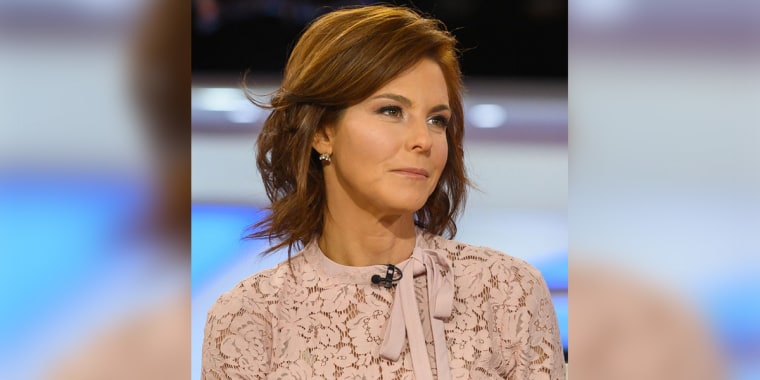

Budgeting can be a little like dieting, said MSNBC anchor and NBC News senior business correspondent Stephanie Ruhle. If you suddenly stop your healthy eating plan, you might be tempted to eat an entire box of cookies in one sitting because you can. “If you start swiping your credit card, you might have a hard time knowing when to stop,” said Ruhle. Here are five ways to help keep your spending under control.

1. Make a plan.

First and foremost, make a plan. Your budget likely changed at some point during the pandemic. Take another look at it now that you can spend a little more freely. Budgets are living documents and need to be updated to suit your needs in the moment. Having the mental framework is helpful, even if you need to change it again. “It’s key to make a roadmap,” said Ruhle.

2. Consider the “why” behind your spending.

Think about how you want to spend your dollars now that states are starting to reopen, suggested Ruhle. Aligning your spending with your priorities can help in making mindful purchases. If supporting local business is important to you, maybe that means ordering dinner to go from a local restaurant, but only once or twice a week. If you want to feel less restricted in your spending, consider setting a dollar limit on impulse buys at the store. Whatever will work for you, make a list, and keep that in mind before you hand over your card.

3. Give yourself the tools to hit “pause.”

There are a few easy ways to help keep your spending in check. If you are able to spend in person, try a cash diet. Withdraw exactly what you are willing to spend that day, month, or week, in cash. “When the money’s gone, it’s gone,” said Ruhle. No online shopping, no swiping of your credit card, no tap and go cell phone payments. A cash diet is a great way to spend exactly what you have budgeted for, especially if you have a tendency to go overboard with online purchases.

If you can use cash or feel yourself overspending quickly, put a 24-hour pause on your purchases before you click “buy.” That little break will give you time to think about whether you really need that item. “Remember, you budgeted a certain dollar amount,” said Ruhle. “Ask yourself, ‘Is it worth going over budget?’”

4. Track your spending.

Hang onto your receipts, jot your purchases down on a pad or in a note on your phone, and make sure you know where your money is going. “That way, at the end of the month, you can look back and see where you were spending and figure out where you need to adjust your plan if need be,” said Ruhle.

5. Give yourself permission to spend within your means.

Much like a diet, overspending can easily cause a guilt trip. We all make mistakes, and you can always make a return or take a spending break if you mess up. Make your plan and let yourself follow it. “Work hard on yourself, don’t be hard on yourself,” said Ruhle.