The coronavirus pandemic has hit the American economy hard with more than 30 million people are out of work. Uncertainty can be scary, especially when it comes to money. But making a plan you can stick to can go a long way.

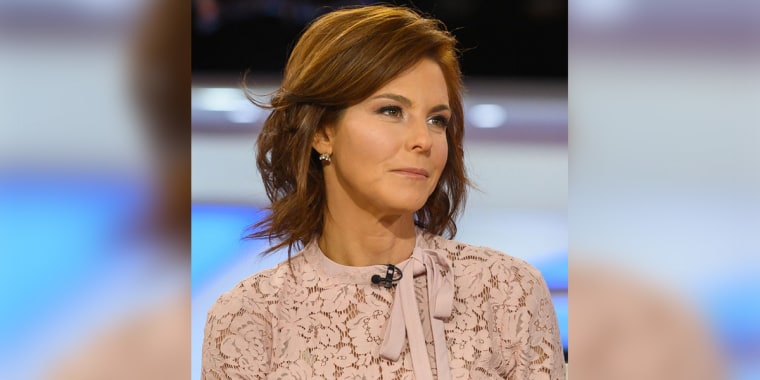

MSNBC anchor and NBC senior business correspondent laid out five smart moves you can make in order to create a budget that will work with your income and meet your essential needs.

1. Determine where your money is going.

Making a budget you can easily follow is next to impossible without following your money. It can be easy to swipe a credit card and not think about it, especially when anxiety is at an all-time high.

“Look at all your receipts and credit card statements, and note where you spend your cash,” said Ruhle. “You gotta write it all down.”

Think about what you can realistically cut back on and make sure you aren’t paying for items or services that you are not using. For example, if your city is under a stay-at-home order, make sure that your gym isn’t still charging you a monthly fee. If you are using subscription services, think about consolidating or canceling any that aren’t necessary.

2. Figure out your essential costs.

Identify your truly necessary expenses, like rent or mortgage, groceries, utilities and loan payments that you can’t defer. Add those numbers up and you have your essential costs.

“You need to make sure those expenses are covered as best you can,” said Ruhle.

3. Negotiate some of your expenses.

If you are dealing with a loss in income, try to negotiate down some of your fixed expenses. If you can’t get rid of them entirely, it’s worth trying to lower the numbers. If you are still working but are making less than usual, you can put your retirement account contributions on pause, said Ruhle.

You can also request a deferment on your mortgage or other loans if you need to. If you need an extra break, try calling your credit card company to negotiate your interest rate.

“This isn’t forgiveness,” Ruhle stressed. “It won’t make those expenses go away entirely, but you’ll be able to build in some time to get the money to cover them … You have to pick up the phone and negotiate.

If you’ve incurred any late fees on credit cards, call up the companies and ask that they be waived. Many credit card companies will honor one-off requests like these even in normal times.

4. Come up with a plan and stick to it.

When it comes to items like groceries, which are essential but not fixed, make sure you are making a plan and budgeting for it. Go to the store with a list of exactly what you need as well as backup items in case things are unavailable. Stick to your list as it can be tempting to make an impulse buy or two. Lowering nonfixed expenses is the fastest way to minimize your spending overall.

“For any good budget, the power is in the planning. The way to stick to the plan is to keep track of the money in and out,” said Ruhle. You can track every day, every time you make a purchase, or once a week. The rules are yours to make, and you can adjust them for your own needs.

5. Try to make budgeting a little fun.

Adding some gratification to the process doesn’t have to cost money. Make a cup of tea you enjoy or take a walk around the block once you’re done tracking all of your expenses and have stayed within your numbers.

“Sticking to the plan is going to help make life easier, even if it feels like everything else is out of control,” said Ruhle.