During Wednesday night's presidential debate, Mitt Romney sought to cast himself as a crusader for financial reform, championing tough new Wall Street regulations and sparring with President Obama over delays in the implementation of several key provisions at the heart of the Dodd-Frank Act.

Romney also sought to paint the president as an ally of Wall Street banks, charging that Dodd-Frank enshrined the status of the "Too Big To Fail" financial institutions, thus guaranteeing future taxpayer bailouts. Dodd-Frank, Romney claimed, "designates a number of banks as 'too big to fail,' and they're effectively guaranteed by the federal government. This is the biggest kiss that's been given to New York banks I've ever seen. This is an enormous boon for them."

There is, perhaps, a legitimate critique to make of the President's signature financial reform bill -- specifically, that it didn't go far enough in constraining the power of the nation's biggest banks, and that it should have broken up banks deemed "too big to fail."

Nonetheless, Romney's argument is disingenuous. For one thing, Dodd-Frank actually subjects those "too big to fail" banks to much stricter regulatory scrutiny and capital requirements. And it doesn't guarantee that they'll be propped up taxpayers (in fact, it gives federal authorities the power to wind down those banks if they are ever in danger of collapsing).

So Romney's claim is wrong on policy. But it's also politically disingenuous, because the very agencies responsible for writing and enforcing the rules at the heart of Dodd-Frank -- such as the Consumer Financial Protection Bureau -- have been under relentless attack from Republicans seeking to neuter or eliminate them since the day Dodd-Frank was passed in July 2010. And for their efforts, Republicans have been handsomely rewarded by their patrons on Wall Street.

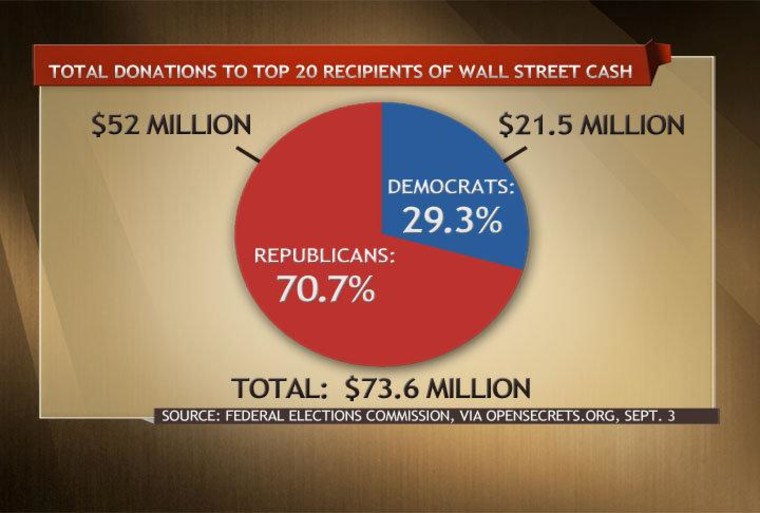

The graph above represents the total number of donations given to the top 20 recipients of campaign cash from the finance, insurance and real estate industries, according to Federal Election Commission data compiled by the Center for Responsive Politics. Of the nearly $73.6 million given to those 20 candidates, including President Obama and Mitt Romney, more than 70 percent, or $52 million, has gone to Republicans.

Romney has received the most, by far. Donors in the finance, insurance and real estate industries have given him more than $28 million as of September. President Obam has received just over $12 million from those sources.

After the presidential candidates, the top recipients of donations from finance, insurance and real estate sources are Massachusetts Sen. Scott Brown, Texas Gov. Rick Perry and House Speaker John Boehner. The top Democratic recipient of finance, industry and real estate cash is Sen. Kirsten Gillibrand of New York. Of those top 20 recipients, seven are Democrats, and 13 are Republicans.

:: Sal Gentile (@salgentile) is a segment & digital producer for Up w/ Chris Hayes ::