The Mitt Romney camp is calling a non-partisan, independent analysis of the candidate’s tax plan "a joke."

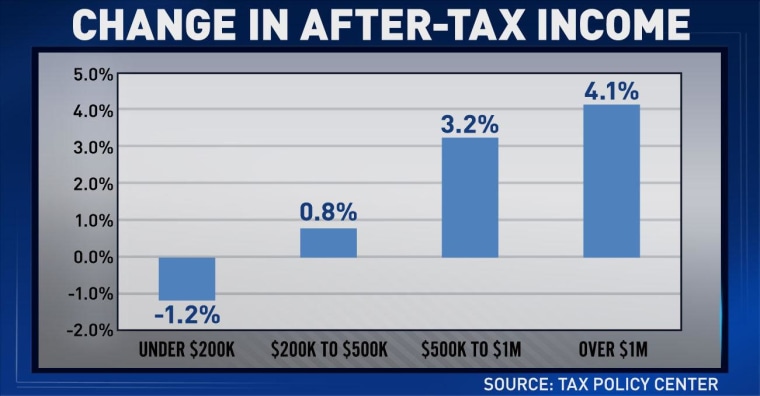

But the middle class is not laughing. The Tax Policy Center report shows the Romney plan would raise income for people making more than $200,000 a year while cutting income for those making less.

And keep in mind, the Tax Policy Center gave Romney the benefit of the doubt when testing the plan, accounting for "implausibly large growth effects" from tax cuts.

Under that best-case scenario, Romney has said the plan would work because rich people would pay the same as they do now, or more.

"For middle income families, the deductibility of home mortgage interest and charitable contributions, those things will continue,” Romney said Feb. 22 in Chandler, Arizona. “But for high income folks, we're going to cut back on that. So we make sure that the top 1 percent keeps paying their current share they're paying now or more.”

But here are some "tax expenditures" that would need to be cut from the tax code in order to lower rates across the board:

- Employer provided health insurance

- Social Security benefits

- moving expenses

- education-related tax credits

- medical expense deductions

- state and local taxes

- mortgage interest

- charitable contributions

Not only is it implausible to cut most of those credits, there aren't enough of them to make up for the size of the tax cut for the rich.

So what else could Romney do, cut spending?

According to the TPC report, "cutting spending would make the plan even more regressive because government spending tends to benefit low-and middle-income households."

And if Romney did cut spending, we already know it wouldn't come out of the military.

"I will reverse President Obama's massive defense cuts,” Romney said at The Citadel in October 2011. “Time and again, we have seen that attempts to balance the budget by weakening our military only lead to a far higher price in the future.”

For a guy running as businessman-in-chief, his tax plan is an across-the-board dud.

Economist Dean Baker joined guest host Michael Eric Dyson last night on The Ed Show:

"I don't see any way to interpret his plan and be more generous to the middle class," Baker said. "Unless you're going to say he's not serious about having balanced cuts, in other words, he's just going to give people a big tax cut and not pay for it, which may be what he intends. But that's certainly not what he's saying."