We talked earlier about a new report from the nonpartisan Tax Policy Center, which scrutinized the tax plan in the House Republican budget, crafted by Paul Ryan (R-Wis.), and endorsed by Mitt Romney. This afternoon, the specific analysis (pdf) was released, which allows us to dig a little deeper.

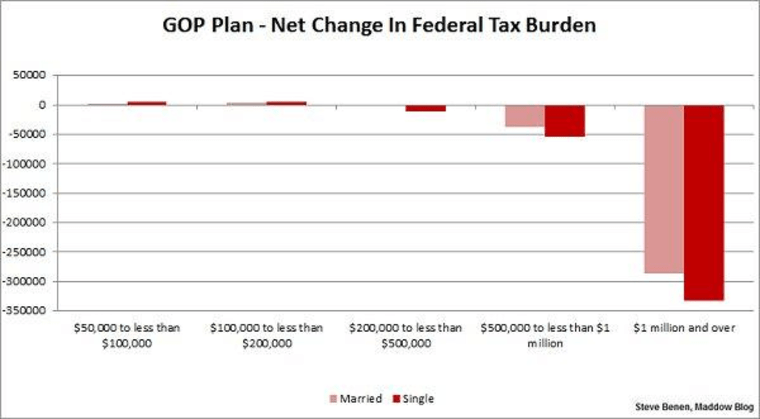

Here, for example, is a chart I put together showing the net change in federal tax burdens by income group. The darker red shows the change for single workers; the lighter red shows the change for married couples filing jointly.

In case this isn't obvious, the middle class would pay a little more every year, while the very wealthy would benefit enormously. In other words, if you liked the ineffective, budget-busting Bush/Cheney tax cuts, you'll love the Paul Ryan plan endorsed by Romney.

The main difference: under the Ryan/Romney model, millions of middle-class workers will actually end up paying more in taxes.

As for fiscal responsibility that Republicans occasionally pretend to care about, the Tax Policy Center's Roberton Williams added, "The Ryan plan as laid out is a revenue loser and would make it harder to bring the deficit under control."

It's quite a plan, isn't it? A windfall for the rich, higher taxes on the middle class, and an increase in the deficit. As Josh Marshall joked, "What's not to love?"