Congress had until midnight yesterday to reach a deal on keeping student-loan interest rates low, but as we discussed on Friday, lawmakers barely tried to reach an agreement and the deadline came and went. Suzy Khimm reports today on the consequences.

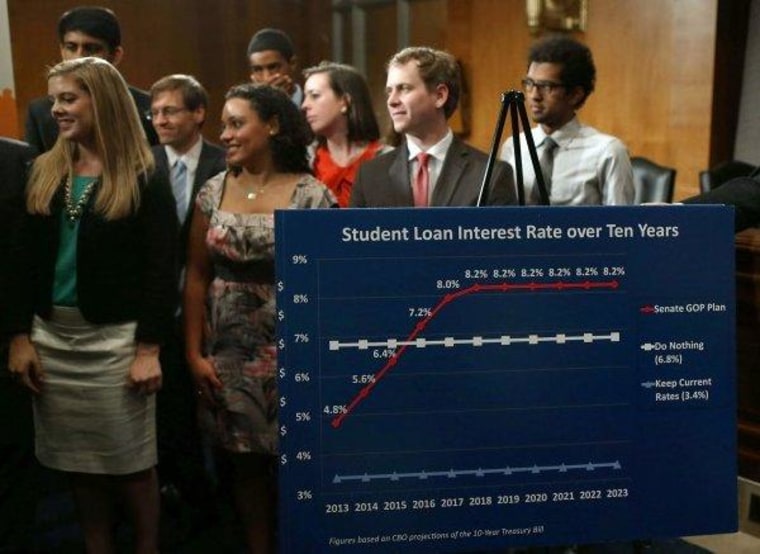

Borrowing costs for lower-income students shot up on Monday, jumping from 3.4% to 6.8% on subsidized Stafford loans from the federal government. For the average borrower, that means an additional $761 for every loan they take out through the program, according to Mark Kantrowitz, a financial aid expert and publisher of Edvisors Network.Neither party is thrilled about the outcome. But in contrast to last year's student loan fight, when both presidential candidates took to the bully pulpit on the issue, there seems to be little sense of urgency coming from Congress or the White House, despite the absence of any clear resolution.

Part of the reason there was no 11th-hour scramble to reach a deal is that the timing is relatively inconsequential. I was under the impression that the rate hike would apply to everyone currently paying back their Stafford Loans at 3.4%, but that is not the case -- a Senate source confirmed this afternoon that the higher rate only applies to new loans, not existing ones. In other words, the rate hike only applies to those who received their student loan literally today.

And since most students seeking higher-ed loans will be going through the process for the fall semester, the calendar offered lawmakers a bit of a cushion.

But what about those folks who are adversely affected by the higher rate? Both parties think they can work something out eventually, and apply the lower rate retroactively to today's date.

Is that likely? At this point, Senate Dems haven't been able to pass a bill, but they nevertheless have a plan.

Khimm added:

Senate Democrats do have a new plan of action, rallying behind a short-term fix that would extend the lower 3.4% rate for subsidized Stafford loans for one year. That's what Congress did last year when the deadline first came up, prompted by 2007 legislation that lowered the rates for just five years.The new Senate plan has the support of Sen. Majority Leader Harry Reid of Nevada and Iowa's Sen. Tom Harkin, chair of the Senate's health and education committee. The $4.6 billion fix would be paid for "by closing a loophole that currently allows those who inherit certain IRAs and 401(k)s to avoid paying the taxes on those accounts for many years," according to a statement from Harkin's office. It would also have a retroactive fix for loans made in the month of July at the higher 6.8% rate.

We don't yet know if this can pass either chamber, but expect the fight to heat up once lawmakers return next week.