There was an interesting exchange about tax policy yesterday between CNN's Jake Tapper and Mick Mulvaney, the far-right director of Donald Trump's budget office, who made the rounds on the Sunday shows to help defend the regressive Republican tax plan.

TAPPER: So I guess the big question is, how can Republicans and the White House propose a bill that would simultaneously cut taxes for the wealthiest Americans, while effectively creating more of a financial burden for Americans earning less than $30,000 a year?MULVANEY: Yes, the bottom line is that the White House, the president is not going to sign a bill that raises taxes on the middle class, period.

I'm not sure Trump World fully appreciates the degree to which the president will struggle to keep this promise.

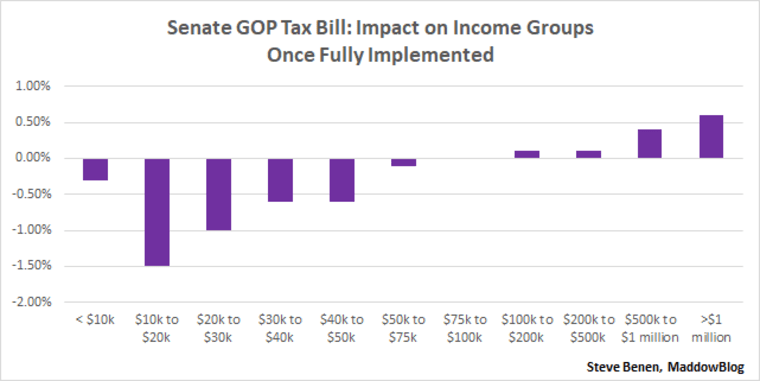

After all, it was just last week that the Joint Committee on Taxation, the congressional office responsible for non-partisan analyses of tax bills, found that once the Senate Republican legislation is fully implemented, American households earning between $10,000 to $75,000 would pay more in taxes, while the wealthy would pay less.

Here's the breakdown in chart form:

The image shows the percentage change -- not the specific dollar amounts, but the percentage -- in income in 2027, assuming the Senate GOP bill, as passed last week by the Senate Finance Committee, is fully implemented.

What's more, the Center on Budget and Policy Analysis published a related report, noting that the Joint Committee on Taxation's breakdown didn't factor in other Republican provisions of the bill, including a repeal of the estate tax and a repeal of the Affordable Care Act's individual mandate, which will disproportionately punish the poor and middle class. The chart looks slightly worse -- which is to say, people at the bottom are punished even more.

Gary Cohn, the director of the National Economic Council at Trump's White House, told the Wall Street Journal last week, "The only way to grade whether it's successful or not is to literally look at the tables, look at the distributions and say, does this do what we want it do and does it deliver tax relief to hardworking American families? And the answer to both bills [in the House and Senate] is, yes it does."

The evidence to the contrary is overwhelming. Cohn says he wants everyone to look at the distribution tables, but when we do exactly that, the data says the opposite of what he wants it to say.

It's against this backdrop that Mick Mulvaney told a national television audience that the president "is not going to sign a bill that raises taxes on the middle class."

This creates an awkward set of possibilities. Maybe the White House will try to redefine "middle class" to exclude Americans in the middle class. Perhaps Trump World will argue that forcing the middle class to pay more in taxes doesn't count as "raising" taxes. Maybe Mulvaney was just brazenly lying.

Or perhaps Mulvaney was telling the truth, Trump is prepared to veto his party's tax plan, and Republicans will have no choice but to start over.

But if you think there's any chance that this last option may come to fruition, you're setting yourself up for disappointment.