Once the fiscal agreement reached by Senate Minority Leader Mitch McConnell and Vice President Biden was announced, one thing became clear: both liberals and conservatives were convinced their purported allies had given away far too much, tilting the deal heavily in their rivals' direction. Of course, logic suggests they can't both be right.

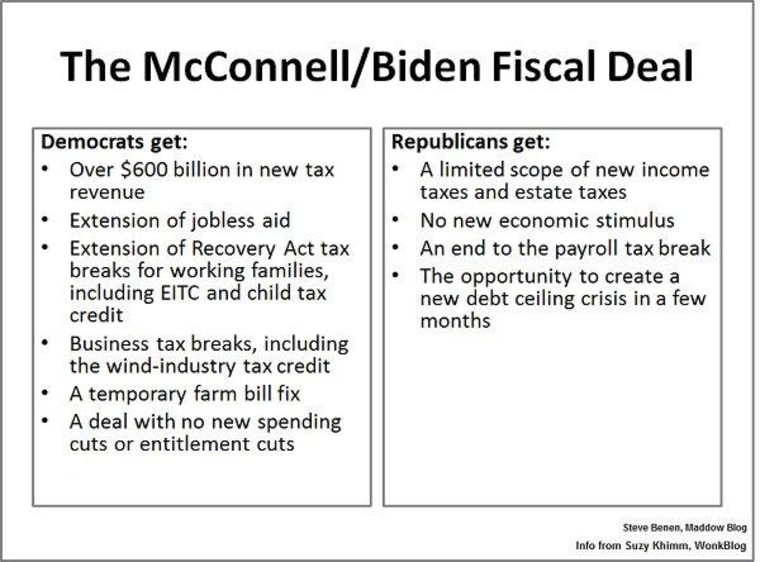

Using Suzy Khimm's summary of the agreement as a guide, here's a tale of the tape.

It's also worth noting that the deal included some provisions that both sides wanted, such as another "doc fix" on Medicare reimbursements and a permanent Alternative Minimum Tax correction, which don't really count as a concession or a gain for either party.

What's more, the automatic sequestration cuts remain very much in play -- they've been delayed by two months -- and will require policymakers' attention very soon.

That said, we can expect liberals and conservatives to continue to make the case that the deal could have been vastly better. For the left, Democrats accepted too many concessions, giving up tax revenue from the wealthy they likely would have secured if the deadlines went unmet and the new Congress had to scramble for a deal.

For the right, Republicans managed to protect some tax breaks for the wealthy, but really only mitigated damage. The GOP still ended up accepting a plan with over $600 billion in new tax revenue, but no Medicare cuts, no Social Security cuts, and no new spending cuts of any kind. Charles Krauthammer, an influential voice on the right, called the agreement a "complete rout for Democrats" and "complete surrender" for congressional Republicans.

We'll explore this in more depth as the day unfolds, but I'd stress one particular angle to this that hasn't received as much attention. For some of Obama's critics, the president could have, and should have, stuck to his guns on the $250,000 tax threshold. If he'd held firm, the argument goes, he would have won that fight.

The criticism has real merit, but from the White House's perspective, that wasn't really a fight worth winning -- Obama and his team had other priorities, and by accepting modest concessions on income thresholds, they were able to secure more victories.

In other words, for the president, had he stuck to the $250,000 line, he probably would have won more revenue, but he might have lost a continuation of the Earned Income Tax Credit and/or the child tax credit. He could have been firm on estate taxes, but he would have been forced to find offsets for extended unemployment benefits.

Instead, Obama traded some revenue for more benefits, all while pocketing the largest tax hike in decades, and leaving entitlements alone.

The White House realizes many on its left flank are unsatisfied, but as far as folks in the West Wing are concerned, they won this round. In the 2011 agreement resolving the debt-ceiling crisis, Democrats felt forced to accept a deal with no new revenue. In the 2012 fiscal deal, Republicans felt forced to accept a deal with no new spending cuts.

There's a critical element on the horizon -- the next crisis is two months away -- but for now, Obama's team believes it got what it wanted out of this process.