The point of the Consumer Financial Protection Bureau is pretty easy to figure out: the agency's name offers a pretty big hint. The CFPB was created to protect consumers' interests against unfair financial industry practices.

At least, that was its intended purpose. As Slate noted the other day, the bureau's mission statement has received a Trumpian makeover.

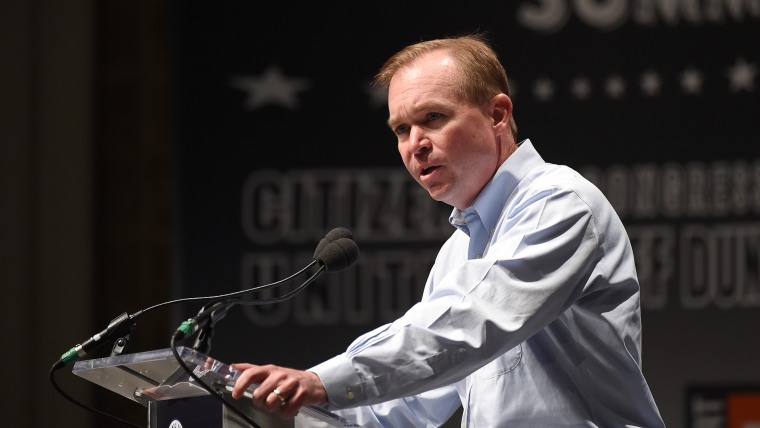

The latest is the Consumer Financial Protection Bureau, the crisis-era creation of Sen. Elizabeth Warren charged with investigating the deceptive practices of lenders, wire services, auto dealers, credit card companies, and so on. The banking watchdog's mission statement now lists its first order of business as hunting down "outdated, unnecessary, or unduly burdensome regulations."Slate has reached out to the CFPB for comment, but the change can likely be traced to the arrival of Acting Director Mick Mulvaney, who took over the CFPB on Nov. 27. The South Carolina Republican is also the director of Trump's Office of Management and Budget, and as the Intercept's Dave Dayen reports, has quickly moved to fill the ranks of the CFPB with Trump loyalists.

Mulvaney, as regular readers know, has repeatedly and publicly condemned the existence of the CFPB, which the president asked him to lead, and which he's dramatically changing the direction of.

This is, of course, an important piece to a larger puzzle: when given opportunities to champion the interests of consumers and working families, Trump always seems to do the opposite.

The New York Times had a good piece along these lines two weeks ago, before the CFPB changed its mission statement in a more bank-friendly way.

[T]his week, the president hopes to sign with great fanfare a tax bill that would deliver its largest benefits, not only in dollar terms but also as a percentage increase in income, to corporations and the wealthiest Americans. [...]Last week, the Federal Communications Commission, led by Mr. Trump's pick as chairman, Ajit Pai, reversed the Obama-era policy known as net neutrality, over the objections of consumer groups and owners of small internet businesses. [...]In the coming weeks, the Education Department plans to roll back protections for college graduates saddled with student debt from sham for-profit universities. And in the opening months of his presidency, Mr. Trump signed congressional resolutions permanently reversing rules that would have required companies seeking significant federal contracts to disclose violations of labor standards, and would have required oil, gas and mining companies to disclose payments made to foreign governments in exchange for access to drilling or mining rights.By reversing one rule, the administration impeded states from establishing retirement programs for private-sector workers whose employers do not offer a retirement plan. Another rule that was eliminated would have required retirement planners to agree that financial advice had the client's best interest at heart, not the investment company's.

We've seen this play out in ways large and small. Note, for example, that shortly before the holidays, Trump scrapped an Obama-era rule on airline transparency on baggage fees, with the Republican administration once again siding against consumers.

I'm trying to think of a single example from 2017 in which Trump, the self-proclaimed champion of the "forgotten" working class, sided with consumers' interests above businesses' interests. Nothing comes to mind.