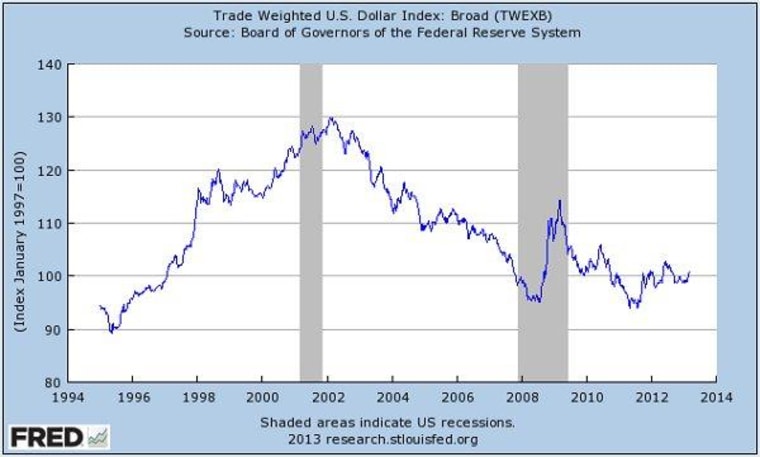

I've never been altogether clear on when and why the right takes the value of the U.S. dollar seriously. For almost the entirety of the Bush/Cheney era, the dollar saw a precipitous decline in value, but this was of no real interest to conservatives. The issue was deemed irrelevant.

After the dollar spiked in 2009 at the height of the global crisis, its value again dropped, but this time, many conservatives responded with horror, apparently motivated by a desire to blame President Obama for ... well, I'm not really sure.

But now the dollar's value is increasing once more. The Wall Street Journal reported yesterday that the "Almighty Dollar Is Back," a reversal "driven by the relative health of the U.S. economy that has strengthened the greenback's role at the center of the global financial system."

Neil Irwin takes stock of why the dollar "is actually on a bit of a tear."

[T]he tendency to view the value of the dollar as a referendum on how Ben Bernanke and Jack Lew are doing their jobs on any given day misses a lot. If the economic outlook improves, whether because of policies enacted in Washington, or because of the natural resilience of the U.S. corporate sector, or because somebody finds a Saudi-sized heretofore unknown oil reserve in the middle of Kansas, the dollar will rise. A key part of the reason that the dollar would rise on that improved outlook would be that investors expect the Fed to raise interest rates more and sooner than they would otherwise. But this is a case where the Fed is the cart, and the economy is the horse.What has happened in the last few months is essentially a more modest version of exactly that.

I've long believed much of the discussion on monetary policy is based on misleading adjectives, so it's worth emphasizing that a "weak" dollar is not always bad news, and a "strong" dollar is not always good news. In monetary policy, these words' everyday meaning doesn't apply.

That said, given the latest news, we do know one thing for sure: everything Paul Ryan was saying about monetary policy two years ago was backwards.