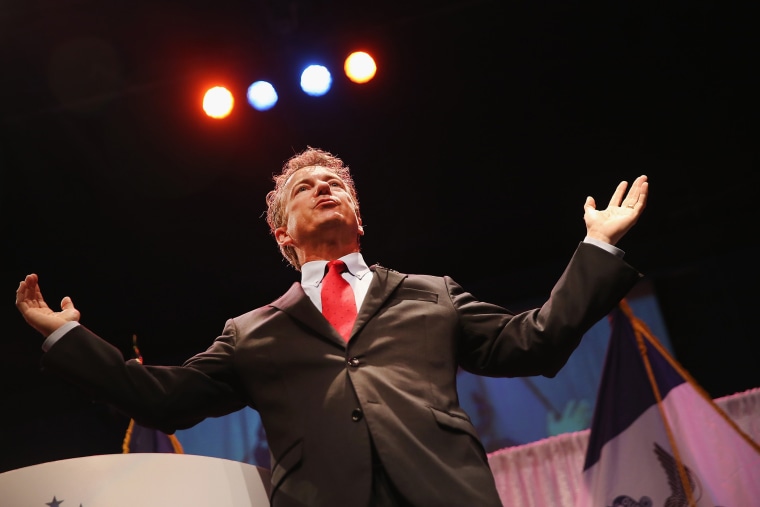

The first sign of trouble in Sen. Rand Paul's (R-Ky.) new tax plan was clear before it was even unveiled. The Republican presidential candidate assembled "an all-star team of the kookiest pseudo-economists in the history of the Republican Party" to help him craft a plan, which effectively guaranteed the proposal's ridiculousness.

But as Kevin Drum explained at Mother Jones, it's probably worse than you think,

According to Paul, the rich will end up paying 14.5 percent in taxes, with no loopholes to pay less. Given that the rich currently pay about 22 percent of their income in federal taxes, they should be pretty happy about that. They should also be pretty happy that he's getting rid of the estate tax entirely. And the middle class? Well, they no longer have to pay payroll taxes. Just 14.5 percent of their income.

The goal, obviously, is to establish a "flat tax." Under the current federal system, there are seven marginal brackets, which rise progressively based on income. Under Rand Paul's vision, there will be one rate. Period. Full stop.

The ideological case against a flat tax has been obvious for years: it's inherently regressive. The United States has long accepted the principle that the wealthy shouldn't just pay more than the poor, but also proportionately more because they're better able to shoulder the burden.

But ideology aside, the real problem with plans like Paul's is that the numbers don't come close to adding up. The Kentucky Republican claims to want to balance the budget in a hurry, but he also supports a tax plan that would blow a multi-trillion-dollar hole in the budget.

"It will be the largest tax cut in American history," Paul boasted this week, "and a tax cut that will leave more money in the paychecks of every worker in America."

Both claims are probably true -- no president has ever considered recklessness on this scale before, and every taxpayer would probably get a sizable tax break. But that doesn't change the fact that the plan is hopelessly bonkers for a variety of reasons, not the least of which is that it defies arithmetic. We can't afford trillions of dollars in tax cuts.

There is, however, a larger context to keep in mind, because Paul isn't the only one pushing this kind of nonsense.

In 2012, Mitt Romney conceded that a flat tax was simply not going to work. In 2015, the number of GOP candidates pushing a flat tax is almost alarming.

Rand Paul, not surprisingly, appears to be the most ambitious, but just in recent weeks, Mike Huckabee and Ben Carson have aggressively touted their own flat-tax plans. Ted Cruz hasn't offered any details, but he apparently has an absurd proposal in the works, too. Other Republicans are likely to follow.

Paul Waldman argued in March, "When Steve Forbes made a flat tax the centerpiece of his 1996 campaign for president, it was met with a certain degree of puzzlement. Here was a guy who inherited a huge fortune, talking about how the rich shouldn't have to pay so much in taxes. (In a weird coincidence, his plan would have saved him a couple of billion dollars in taxes over the course of his lifetime.) But before long, in Republican circles the flat tax became, if not quite dogma, then certainly the default option for candidates."

For those of us with access to calculators, it's not a positive development.