If you've ever seen some of the Republican attack ads launched by Crossroads GPS, chances are you didn't think the commercials came from a "social welfare" non-profit organization. But we were reminded yesterday that the law in this area can get a little murky.

The Washington Post reported on an unexpected decision from the IRS, following years of review.

The Internal Revenue Service has granted tax-exempt status to Crossroads GPS, a conservative group that has aggressively pioneered in a new form of political engagement by nonprofit groups sanctioned by the Supreme Court's Citizens United decision. The decision by the IRS -- first reported by OpenSecrets.org, the website of the nonpartisan Center for Responsive Politics -- means that Crossroads GPS has been deemed a "social welfare" nonprofit under Section 501(c)(4) of the tax code.

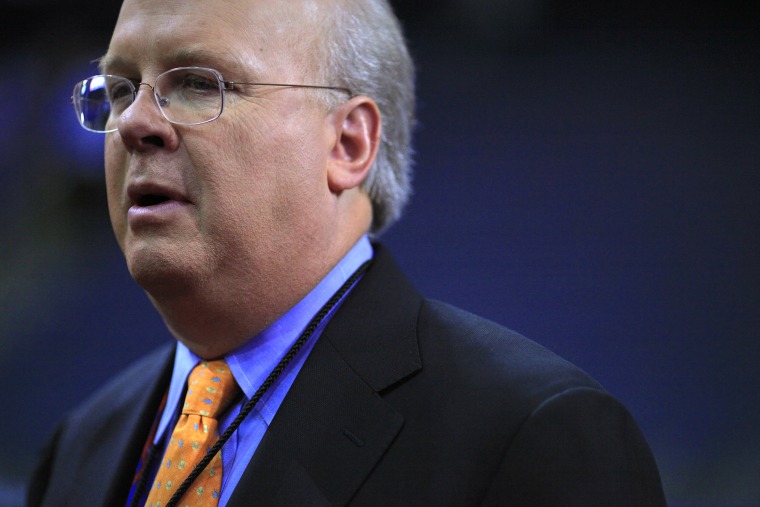

Just so we're clear, Karl Rove and former Republican National Committee chairman Ed Gillespie created a super PAC several years ago called American Crossroads, which plays a prominent role in Republican politics. Crossroads GPS is a companion entity, which is also a high-profile role in the party, but plays by a different set of rules.

One of the benefits of creating a 501(c)(4) non-profit is secrecy: these groups can collect unlimited amounts of money from just about anyone, invest that money in political campaigns, and keep their donors' names secret from the public. The organizations are popularly known as "dark money" groups because there is no disclosure, and the financing is kept in the shadows.

What's the catch? Under federal tax law, in order to qualify for non-profit status as a 501(c)(4) "social welfare" group, the organization has to ensure that a majority of its work is not overtly political. Or put another way, for every dollar one of these organizations collect, 51 cents has to go towards some kind of "social welfare" purpose -- and campaign attack ads don't count.

In this case, Crossroads GPS assured the Internal Revenue Service that it's been following the letter of the law carefully, devoting a majority of its resources to education and policy research, not campaign intervention.

Critics have long scoffed at the argument, but as of yesterday, the IRS is evidently willing to accept it -- a decision political scientist Norm Ornstein described as "farcical."

So, the next time you see a commercial Crossroads GPS, telling you how awful some Democrat is, remember that it's not an attack ad from some partisan outfit; it's a message from a "social welfare" non-profit organization.