WALLACE: Then there's another complaint, and that is the issue of who benefits. The Tax Foundation says the middle class would see after tax income increase 2.9 percent. But the top 1 percent would get a boost of 11.6 percent. An analysis of your tax returns for the last six years, which you have released to the public, the last six years indicates that you would save, under your tax plan, $3 million. Does Jeb Bush need a $3 million tax cut? BUSH: Look, the benefit of this goes disproportionately to the middle class. If you look at what the middle class pays today compared to what they would pay in our tax plan -- WALLACE: But they get a 2.9 percent increase in after tax income -- BUSH: Because higher income people pay more taxes right now and proportionally, everybody will get a benefit. But proportionally, they'll pay more in with my plan than what they pay today. WALLACE: Well, I mean, forgive me, sir, but -- but 2.9 seems like it's less than 11.6. BUSH: The simple fact is 1 percent of people pay 40 percent of all the taxes. And so, of course, tax cuts for everybody is going to generate more for people that are paying a lot more. I mean that's just the way it is.

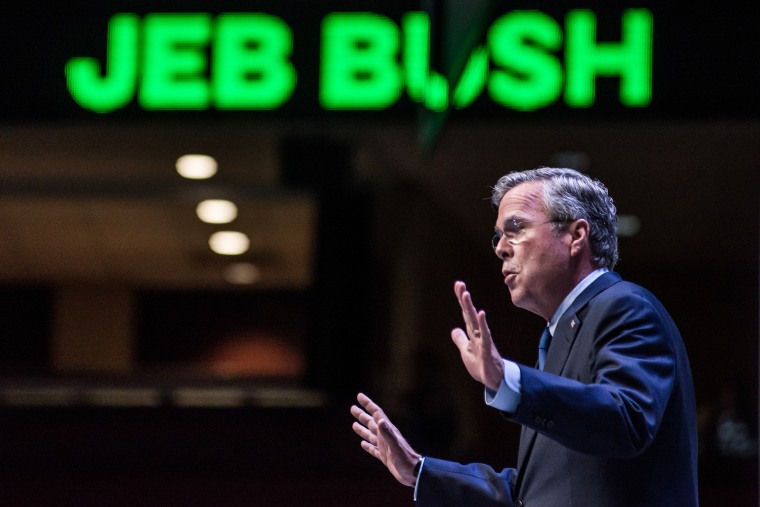

Jeb Bush stumbles on 'the way it is'

To hear Jeb tell it, the effects are effectively out of his hands -- he has to cut taxes and he has to deliver the bulk of the benefits to the rich.

Jeb Bush's tax plan, outlined a couple of weeks ago, is burdened by some fairly serious flaws. It is, for example, a multi-trillion package that the Republican can't pay for. It's also built on a series of trickle-down assumptions that are hard to take seriously.

But there's also the plain, political reality: in a year in which economic populism is striking a chord, the former governor is pushing a plan that disproportionately benefits the very wealthy. Fox News' Chris Wallace pressed Bush on this specific point yesterday, and pay particular attention to the Florida Republican's closing response.

For Bush, the conclusion is simply unavoidable. He has no choice. To hear the GOP candidate tell it, the effects of the policy are effectively out of his hands -- Bush has to cut taxes across the board and he has to deliver the bulk of the benefits to the rich. "That's just the way it is."

The Republican presidential hopeful may hope voters find this persuasive, but to paraphrase Bruce Hornsby, who sang about those who say, "That's just the way it is," don't you believe him.

The arithmetic on this is pretty straightforward, actually. Even if we concede the premise, and agree that Bush has to cut everyone's taxes, it's actually quite easy to craft a tax policy that benefits working-class families more than the very wealthy. Bush simply prefers a different approach.

He's welcome to defend that preference, of course, but to argue that he simply has no choice but to tilt the scales in the rich's favor isn't true.

As Vox's Matt Yglesias explained, "Bush is right that this is not an idiosyncratic feature of his plan. But he's wrong to say that it's a feature of rich people paying a disproportionate share of the taxes. Instead, it's a straightforward consequence of the Republican Party's commitment to the idea of across the board tax cuts. If you want to cut taxes for everyone without giving away the store to the top one percent, it's easy -- just slash the bottom rate."

In the same interview, Wallace brought up the trickle-down tax breaks embraced by Reagan and Jeb's brother. The former governor insisted that those policies "created a dynamic effect of high growth -- and that's what we need."

But this is wrong, too. Economic growth in the Bush/Cheney era averaged about 1.6%, despite two rounds of massive tax breaks. This isn't "high growth" at all -- it's slower than the growth in the post-recession Obama era, and it's vastly slower than the growth of the Clinton era. For that matter, job growth in the Obama and Clinton eras tops Bush/Cheney-era growth, too.

At its core, Bush's case for more tax cuts seems to effectively come down to, "This policy didn't work for my brother, but it'll totally work for me." If the Florida Republican wants the public to buy the argument, he's going to need to work harder on his pitch.