I went down a bit of a rabbit hole last night trying to understand the nature of competitiveness in the solar industry between the U.S. and China (or really, China and the rest of the world). I know from past posts about alternative energy that the MaddowBlog enjoys a readership with a lot of expertise in this field, so I appreciate your contributions to helping me understand what's going on.

First, for the tl;dr crowd, here's the money quote that was a real revelation to me:

"Instead of subsidizing the purchase and use of solar power, China has focused on building the competitiveness of the country’s manufacturers."

Now, this way to the rabbit hole:

As the investigation into failed solar venture Solyndra proceeds, I'm still stuck on the company's initial explanation for why it closed:

"George Kaiser Family Foundation, an independent charitable foundation, is among many investors in Solyndra and has suffered a loss as a result of the company's inability to overcome serious challenges in the marketplace, especially the drastic decline in solar panel prices during the past two years caused in part by subsidies provided by the government of China to Chinese solar panel manufacturers," the statement said.

So China pumps money into its solar industry which means it can underprice the rest of the world, and as a result, the U.S. can't get a solar industry of its own off the ground? I don't want to sound like a socialist (gasp!) or anything, but shouldn't we be doing more than just offering loans to private businesses that then fail once they get to market?

But wait, before I get all worked up, is this even true?

It seems like it would be true because I distinctly remember when Evergreen took Massachusetts' money and ran to China. But shortly after that, I see the "smart money" seemed to think the U.S. was on pretty equal, if not necessarily profitable, footing with China. And didn't I just read a week or so ago that we had a solar trade surplus with China? Shouldn't that be a positive sign?

The answer is yes and no. It turns out there are two aspects to that trade surplus that tell a deeper story, because our surplus isn't coming from exporting completed solar panels. First, it's from shipping manufacturing equipment. So the good news is that when China grows its solar industry, it buys machines from us to do it. The bad news is that when you sell a man a fishing pole, eventually he doesn't need to buy fish from you. Plus, China is working fast to make its own fishing poles... er... solar manufacturing equipment - or to lure away American companies.

The other thing we sell is polysilicon, which is needed to make solar panels. We are able to make that more cheaply, so we win on the export front there. But again, while that may technically be the solar industry, it's not solar panels.

What else is weird about this story is that it's completely possible that we were doing great two weeks ago and now things look dire. It really seems to change that fast. Last month the U.S. lost a fifth of its solar panel manufacturing capacity to bankruptcies. In fact, wanna see something crazy? Look at these two headlines:

August 29, 2011 - U.S. Posted a Trade Surplus in Solar Technologies, Study FindsSeptember 1, 2011 - China Benefits as U.S. Solar Industry Withers

Withers? That must have been a pretty terrible weekend.

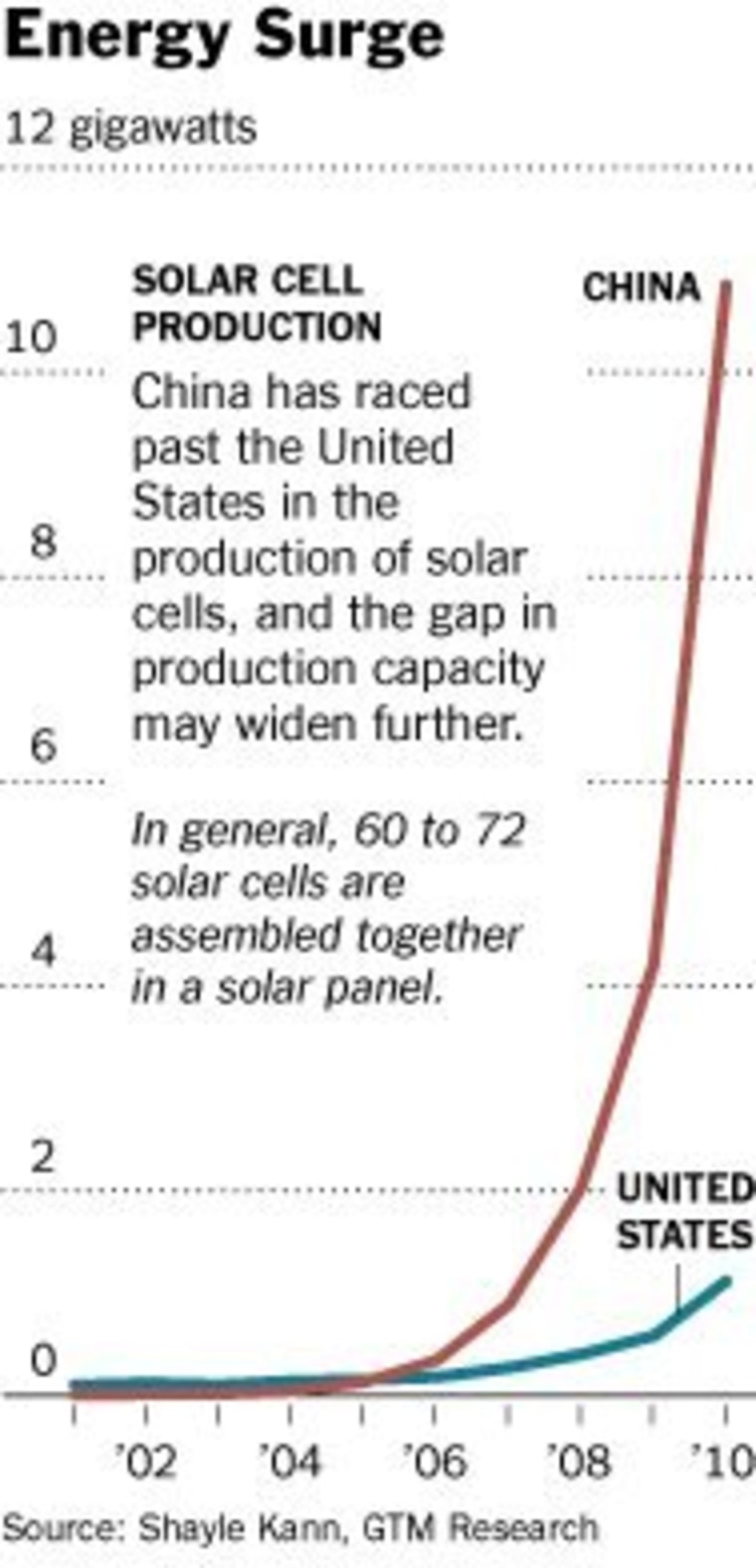

That September 1 story explains the situation well (and is the source for the chart here on the right). See that huge skyrocketing red line? That's China ramping up its production capacity and it's also why they're buying so much manufacturing equipment and polysilicon from us. And it also means they're quickly making back their start-up costs. The way I understand it, as that red line flattens out, their demand for our supplies will drop and we'll be priced out of the market we helped them into.

What else is interesting is that this isn't a case of the U.S. being undercut by labor costs because we have human rights and workers' rights standards. Solar cell production is not labor intensive. Instead it seems the Chinese government is seeing to it that the capital costs of production are so low that the Chinese companies can charge a lower price.

Watching the president's speech last night, this line was particular resonant:

"If we provide the right incentives, the right support -- and if we make sure our trading partners play by the rules -- we can be the ones to build everything from fuel-efficient cars to advanced biofuels to semiconductors that we sell all around the world."

Apparently what the Chinese are doing is not playing by the rules, and Senator Wyden, for one, hopes to do something about it. Then again, we've been down this road before, very recently:

(December 22, 2010) The Obama administration filed a case against China with the World Trade Organization on Wednesday, siding with an American labor union, the United Steelworkers, in accusing Beijing of illegally subsidizing the production of wind power equipment.

From what I understand, by the time China did anything to acknowledge the complaint, they'd already established their wind power production industry. The same is expected with solar.

I guess the bright side is that we can get cheaper solar panels at the expense of Chinese industry subsidies. It's odd to consider what "energy independence" means if we're dependent on Chinese solar. It is alarming to see how quickly the landscape is changing -- certainly more quickly than our no-nothing, stall tactic, filibustering Congress can deal with. There are other factors as well. We've still got technology on our side. Advances are still being made in solar technology that could change the playing field.

I come at this whole matter from a "where's my flying car?" position of impatience, and as usual I find the answer uncomfortably complicated. Obviously this is not my field(s) of specialty, so as ever, I appreciate your help by way of corrections or additions to the above.