Under existing federal law, some congressional leaders have the power to obtain individual tax returns from the Treasury Department. There are no limits on whose returns are accessible, which necessarily gives some members of Congress the ability to access a president's tax returns.

The black-letter law isn't ambiguous: according to the statute, which has been on the books for nearly a century, the Treasury Department "shall furnish" tax materials in response to a formal request from one of a handful of congressional lawmakers, including the chairman of the House Ways and Means Committee.

But when Rep. Richard Neal (D-Mass.), the current chairman of the House Ways and Means Committee, directed officials to "furnish" the materials, the Trump administration balked. Treasury Secretary Steven Mnuchin specifically dismissed Neal's letter as an "unprecedented request" that deserved to be denied. Rep. Kevin Brady (R-Tex.), the ranking member on the committee, used the identical phrase.

In reality, it wasn't really a request -- it was more of an order -- and as the Washington Post noted, it wasn't unprecedented, either.

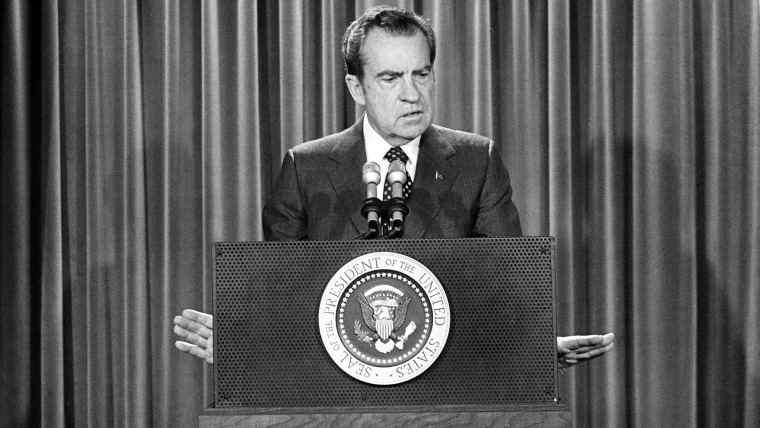

The Internal Revenue Service turned President Richard Nixon's tax returns over to a congressional committee the same day in 1973 that the panel requested them for a review, according to letters released by House Democrats on Thursday.The newly released documents appear to contradict the Trump administration's claims that House Democrats' demands for the president's tax returns are "unprecedented," and suggest a split between this administration and past IRS officials over the interpretation of the law.

The speed with which the Nixon administration honored the law in late 1973 was of particular interest. The relevant lawmaker directed the IRS to provide the then-president's tax materials on Dec. 13, 1973, as part of the investigation into the Watergate scandal.

And on Dec. 13, 1973, the then-IRS commissioner responded with the documents, as was -- and is -- required by law.

The result is an awkward dynamic: the Nixon administration, near the height of the Watergate scandal, was more willing to follow federal law than the Trump administration is now.

What's more, as NBC News presidential historian Michael Beschloss noted on the show last night, when lawmakers scrutinized Nixon's returns, they discovered that the then-president had dramatically under-paid his tax bill.

And yet, the administration still didn't hesitate to provide Congress with the tax materials that proved to be a problem for the sitting president.