Late last week, after we'd learned the economy created nearly a quarter of a million jobs in January, President Obama delivered a not-so-subtle message to Congress: "Don't muck it up."

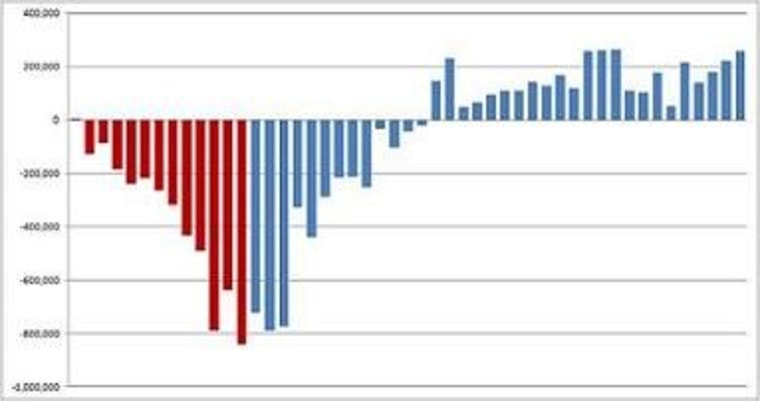

This was not a stray thought from the president. Economic conditions appear to be improving, but Americans have seen encouraging data before, only to have the strength of the recovery falter. The three best months for job creation since the start of the recession were February, March, and April of last year, but the trend didn't last -- the Eurozone crisis, a disaster in Japan, and Republicans' decision to play a suicidal game with the full faith and credit of the United States "mucked" things up.

As Ezra Klein noted this morning, the projections for 2012 look good, but Congress still has the capacity to do real damage to the recovery.

In a perfect world, we wouldn't just smoothly extend the payroll tax cut and the unemployment benefits, but we would begin a large program of infrastructure investment, and we would pass a deficit-reduction package that began in 2014, and the Federal Reserve would step up with a bit more support for the economy. [...]The other option -- perhaps the more likely option -- is that Congress could imperil the recovery by failing to extend the payroll tax and the UI benefits, which could shave as much as a point off growth this year, and signaling it will fail to come to a deal on the Bush tax cuts and the sequester, which could shave even more than a point off growth next year. In that case, businesses and households would have every reason to expect the recovery is likely to sputter out again, and so they'll have every reason to refrain from hiring and investing, which will, in turn, assure the recovery sputters out again.

The worst thing that could happen at this point is for a sense of complacency to take hold. There will no doubt be many on Capitol Hill who will look at the recent progress and argue, "See? We can now start focusing on austerity measures, taking money out of the economy, undermining consumers' buying power, and weakening economic demand on purpose."

That would be a tragic mistake. Getting closer to where one wants to go is not a rationale for slamming on the brakes.