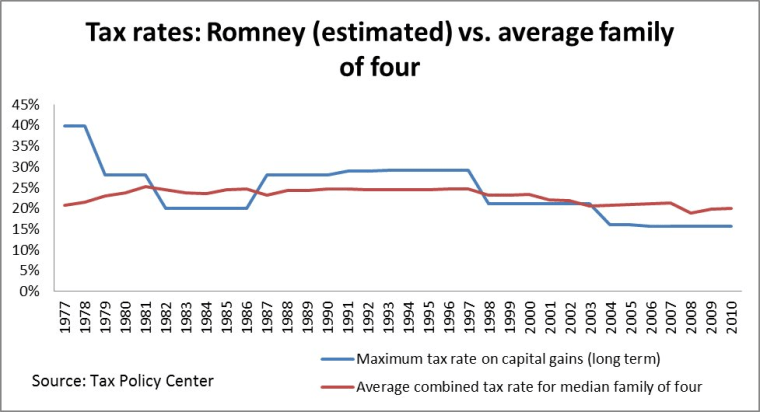

Taking Mitt Romney's own estimate that he pays a tax rate of 15 percent, this chart compares what he owes the IRS to what an average American family would pay. Ethan Pollack of the Economic Policy Institute, who posted the chart, writes that this is a matter of long-term policy choices by our government:

Why is the government favoring Romney’s income over that of most Americans? After all, it's not like he’s been working recently—he’s been running for president for the better part of five years. And even if he did have the time to actively manage his investments, he’s not able to because they’re in a blind trust. As for the risk factor, sure he’s risking his capital, but he’s not bearing any more risk that most households in this economy face. So tell me again, why is it so important for the government to subsidize rich people like Romney at the expense of average American households?

Mr. Romney seems to like the general drift of American tax policy just fine. Under Mr. Romney's plan, the richer you are, the more likely you are to get a smaller tax bill.

The exception to the long trend is the 1990s, when we had higher taxes and -- hey! -- growth.