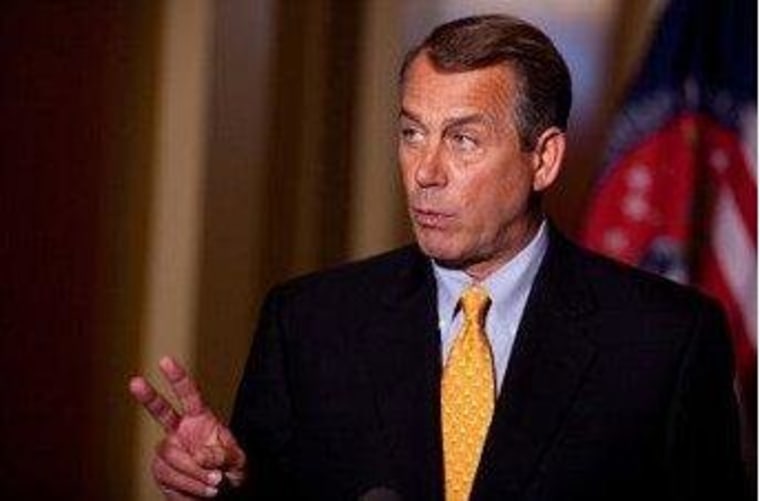

At this point 24 hours ago, there was quite a bit of talk about President Obama and House Speaker John Boehner closing in on a fiscal agreement. The broad outline was in place, and the negotiations were limited to haggling over some of the numbers. But as the day progressed, Boehner heard from his angry Republican colleagues, and the momentum stalled.

"Today was a step back," a top Senate Democratic aide told the Huffington Post yesterday afternoon. "There are two schools of thought. Either the wheels are totally coming off or one wheel has come off and can still be put back on. I'm more towards the former."

There are a few important angles to this, but let's start with the emergence of Boehner's "Plan B." Suzy Khimm had a good summary of the proposal, which is destined to fail.

He plans to hold a vote in the House that would let the Bush tax cuts expire for income above $1 million -- and nothing else.Boehner's proposal is meant to push back against President Obama's new $400,000 threshold for tax cuts: If it passed, it would, at least in theory, take away the White House's leverage on tax cuts that are now set to expire in 13 days.

The Speaker is effectively trying to take the tax fight, which he's been losing, off the table. Plan B includes no spending cuts, no entitlement reforms, no stimulus, no debt-ceiling increases, no effort to address sequestration, and not even the slightest effort to reach a "balanced" deal -- just higher marginal tax rates on income above $1 million.

In an amusing twist, Boehner is trying to convince his caucus that this doesn't count as a tax increase, since it prevents higher taxes on most Americans on Jan. 1. Of course, by that logic, Obama's plan doesn't count as a tax hike, either, and Republicans have invested quite a bit of time and energy arguing the opposite for a long while.

Regardless, Democrats -- both on Capitol Hill and in the White House -- have no use for this Plan B, and suspect its emergence is evidence of Boehner moving away from the negotiations that seemed to be moving forward up until yesterday afternoon.

But Democrats aren't the only ones balking.

Luke Russert said yesterday as many as 30 House Republicans are prepared to oppose Boehner's fallback plan, and National Journal reported that "Republican vote counters" are "unsure" the Speaker's gambit can pass the lower chamber.

... Boehner was running into resistance from some of his own members for his own option. That uncertainty persisted even after a second closed-door meeting between Boehner and rank-and-file members, which was itself a follow-up on an earlier meeting in the day in which the speaker first unveiled his so-called "Plan B." Having to hold two such meetings in one day to explain such a proposal is likely not a good sign for its chances.However, some members said they would back Boehner's plan. "I'm going to be for it, I kind of feel like I'm a lifeguard and there's millions of Americans that are about to drown in a huge tax increase and I'm going to save as many as I can," said Rep. Steve Stivers, R-Ohio.But others wondered why -- with little chance the Senate will pass the Boehner alternative and since it comes with no spending cuts attached -- House Republicans should go on record as voting to raise income taxes on any earners."Once you cross that line and say it's OK for some people's taxes to go up, I think it's a mistake for the Republican Party, so I think that's what a lot of members are struggling with," said Rep. Jim Jordan, R-Ohio.

This is, after all, a public relations stunt -- a fact Boehner makes no effort to hide. He's looking for leverage and a way to avoid blame, and sees Plan B as something of a life-preserver. But for House Republicans who consider millionaires and billionaires "job creators," and who've spent their careers opposing higher tax rates on anyone for any reason, there's little point to the Speaker's little game that won't become law anyway.