It appears Governor Mitt Romney is now questioning his own arithmetic. At a campaign event yesterday, he admitted to voters that they shouldn't count on "a huge cut in taxes."

Why the apparent backtrack? It could be because Romney is finally accepting what independent analysts have been saying for months: his tax plan is mathematically impossible. In an often-cited report, the Tax Policy Center says the only way Romney could implement a tax plan that wouldn't add to the deficit would be to hike taxes on the middle class--that is to say, people making less than $200,000 a year.

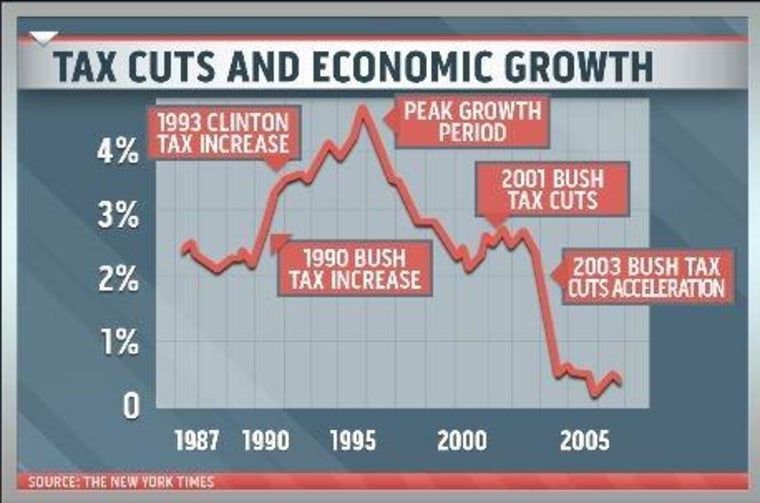

There's more to the mathematical mirage: Romney, like most Republicans, believes the only way to achieve economic growth is by slashing taxes for the highest earners. But the proof isn't necessarily in the pudding, according to the New York Times' David Leonhardt, who joined Alex on the show today. In a recent column, Leonhard printed a chart showing that over the last two decades strong economic growth didn't happen during times of lower tax rates.

Leonhardt isn't arguing that higher taxes lead to more growth. Instead, he's saying that when one looks at all the factors that go into creating a healthy economic environment, a single-minded focus on reducing the marginal tax rates for the wealthy may be misguided. If anything, according to recent column by the Washington Post's Ruth Marcus, lower tax rates for the highest income bracket only add to the growing problem of income inequality. Reason number 1,000,0001 why the trickle never makes it all the way down to the bottom.