In a surprise move designed to give the economy a jolt, the Federal Reserve will tie its monetary policy to the nation’s unemployment rate.

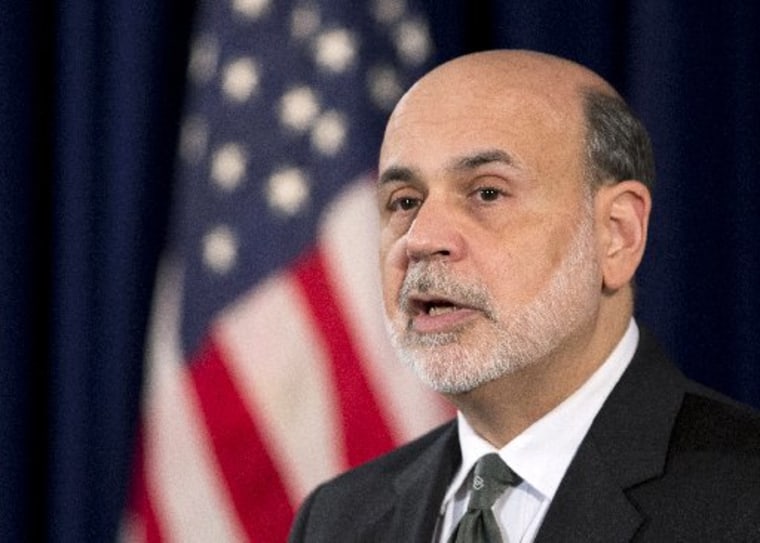

Ben Bernanke and co. announced Wednesday they'll tie the Fed's bond-purchasing program to the national jobless rate—purchasing $85 billion Treasury securities and mortgage-backed securities a month until unemployment falls below 6.5 percent or inflation rises to 2.5%. Last month, unemployment fell to 7.7 percent.

Morning Joe economic analyst Steve Rattner, a former Treasury adviser to President Barack Obama, said the move is “unprecedented.”

The Fed will not allow inflation rates to rise above 2.5%, the announcement said, allowing for the first time that they would allow inflation to rise above 2%, even slightly, in order to reach their economic goals.

This move “should make monetary policy more transparent and predictable to the public,” Bernanke told reporters, adding that he believes the program would continue to keep interest rates artificially low until 2015.

“This is likely to mean low interest rates for a long time,” Rattner said.

The Reserve “will now buy Treasuries outright – previously it has been selling shorter maturity Treasuries and buying longer maturity ones,” Rattner explained. “This amounts to printing money to stimulate the economy, and finance our deficit.”

“All in all, this is a big, bold and correct move by the Fed,” Rattner added. “Another example of good policy from a critically important institution.”