Leading economic indicators are showing signs of a slowdown, according to Steve Rattner, a former Obama economic adviser.

“We’ve had spring slowdowns in the past and it looks like we’re having another one now,” explained Rattner, who walked Morning Joe through several charts that show the decline.

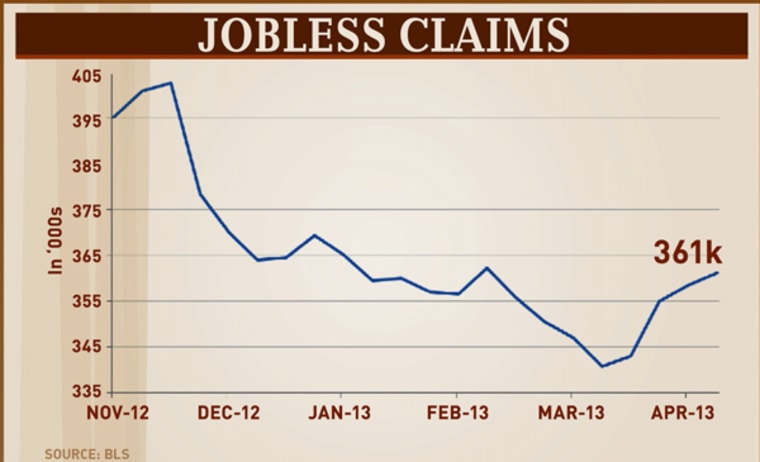

“The first thing we should look at is new claims for jobless, for unemployment insurance, this is a kind of leading indicator of where jobs are going—people who are for the first time coming out and looking for unemployment insurance,” Rattner said.

After months of trending downward during the fall and early 2013, the numbers have ticked up to 361,000 jobless claims. April’s unemployment numbers will likely be as poor as March's, when the country added a measly 88,000 jobs, Rattner said.

“Let’s take a look at another indicator, which is retail sales, also something that had been reasonably strong—consumers had been out shopping,” Rattner said. “Then in March, again, you had a 0.4% drop, this is the largest drop since June of 2012.”

Rattner was quick to caution reading too much into the indicators. “One month does not a trend make, but these are all little signs and wisps that give you reasons to be a little bit nervous,” he said.

The next chart, Leading Indicators, is a monthly index that combines different economic predictors into one number.

“You can see that while it did go down in August 2012, we’ve essentially had six straight months of flat or upward growth, and then it went down. Normally, we want to see something like three months of a trend before we made too much of this, but the fact is: it’s not good news,” he said.

Rattner went on to break down a few of the potential causes.

“We’ve had soft spots in the economy for the first two or three springs, it might be another one of those. But you’ve had the payroll tax increase go into effect. You’ve had sequestration go into effect. You’ve had no growth in people’s incomes,” he said. “If people don’t have money, they can’t spend money.”

Economic factors outside America may also be contributing, too.

"We’re being affected by the slowdown in Europe in particular and the slowdown in the emerging markets. Our export growth has fallen to about zero at the moment, because there isn’t demand overseas for our products," Rattner said. "So it feels like we’re in a bit of a soft spot, but we’ll see."